URD 2023

-

Glossary

Terms

Advanced TV: Advertising medium in which ads are shown in programs and films broadcast via over-the-top (OTT) services on connected TVs (with a built-in Internet connection) or streaming devices.

Digital business transformation (DBT): Consulting services in the transformation of our clients’ business models and their adaptation to the digital world.

Dynamic creativity: Personalized creative content adapted to the consumer according to their characteristics (location, interests, stage in their consumer journey, etc.).

Epsilon CORE ID: The market-leading privacy-safe person-based identifier, designed to help brands accurately recognize and reach consumers across the open web.

Epsilon PeopleCloud: Platform powered by Epsilon’s CORE ID to enable personalized consumer journeys at scale. The platform allows brands to manage and grow their client data, engage with consumers across channels and measure marketing spend to optimize best outcomes.

Global Delivery Centers: Hubs bringing together Publicis Groupe employees available to support the country model, particularly in media, production, data and digital transformation expertise.

Groupe Client Leaders (GCL): The Groupe Client Leader is responsible for all services and skills made available to the client, regardless of the discipline. GCLs have a geographical scope that can be global, regional or country-based.

Industry verticals: Organization of certain Groupe activities according to the clients’ business sector.

JANUS: JANUS is the body of rules of conduct and ethics that applies to all Groupe employees and establishes the rules of business conduct: “The Publicis way to behave and operate”.

Direct-to-consumer brands: Brands selling directly to consumers over the Internet without going through physical distributors.

Platform: Service acting as an intermediary to access information, content, services or goods, most often published or provided by third parties. It organizes and prioritizes content and generally responds to its own ecosystem approach.

Publicis Communications: Until the end of 2019, Publicis Communications brought together the Groupe’s global creative offering, including Publicis Worldwide, Leo Burnett, Saatchi & Saatchi, BBH, as well as Prodigious, a world leader in production, Marcel, Fallon and MSL, a specialist in strategic communication. As of early 2020, this structure no longer exists at the global level as the Groupe has moved to a country organization. It continues to exist in the United States, reflecting the organization's adaptation to the size of the country. Publicis Communications US has also included Razorfish, a digital marketing activity, since 2020.

Publicis Media: Until the end of 2019, Publicis Media brought together all of the Groupe’s media expertise, specifically the investment, strategy, analyses, data, technology, marketing performance and content of Starcom, Zenith, Spark Foundry, Blue 449, Performics and Digitas. As of early 2020, this structure no longer exists at the global level as the Groupe has moved to a country organization. It continues to exist in the United States, reflecting the organization's adaptation to the size of the country.

Publicis Sapient: Publicis Sapient partners with clients in the field of digital business transformation, based on technology, data, digital and consumer experience.

Re:Sources: Re:Sources includes the Shared Service Centers, which cover most of the required administrative functions for the Groupe’s agencies.

Retail media: Purchase and sale of advertising on retailers’ websites and apps, most commonly in sponsored product ad format and based on retailer transactional data.

The Power of One: A unique offering made available to clients by simply, flexibly and efficiently providing all of Publicis Groupe’s expertise (creative, media, digital, tech, data and health).

-

1.Presentation of the Groupe

1.1Groupe history

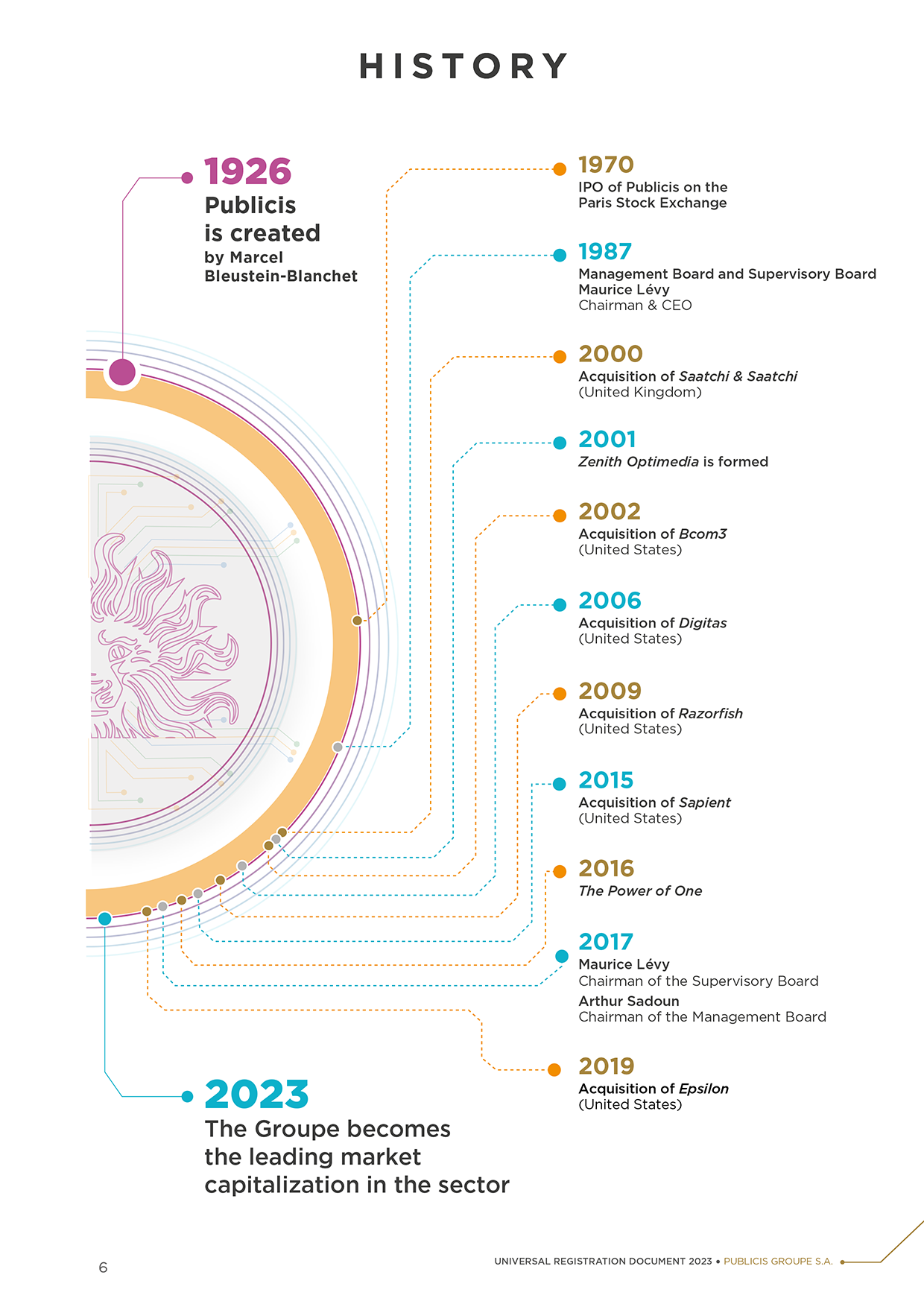

In 1926, Marcel Bleustein-Blanchet created an advertising agency called Publicis, “Publi,” for “Publicité,” which means advertising in French, and “six” for 1926. The founder’s ambition was to transform advertising into a true profession with social value, applying rigorous methodology and ethics, and to make Publicis a “pioneer of modern advertising.” The Company quickly won widespread recognition. In the early 1930s, Marcel Bleustein-Blanchet was the first to recognize the power of radio broadcasting, a new form of media at the time, to establish brands. Publicis became the exclusive representative for the sale of advertising time on the government-owned public broadcasting system in France. But in 1934, the French government removed advertising on State radio; Marcel Bleustein-Blanchet decided to launch his own station, “Radio Cité,” the first private French radio station. In 1935, he joined forces with Havas to form a company named “Cinéma et Publicité,” which was the first French company specialized in the sale of advertising time in movie theaters. Three years later he launched “Régie Presse,” an independent subsidiary dedicated to the sale of advertising space in newspapers and magazines.

After suspending operations during the Second World War, Marcel Bleustein-Blanchet reopened Publicis in early 1946, and not only renewed his relationships with pre-war clients but went on to win major new accounts: Colgate-Palmolive, Shell and Sopad-Nestlé. Recognizing the value of qualitative research, in 1948, he made Publicis the first French advertising agency to conclude an agreement with the survey specialist IFOP. Later, he created an in-house market research unit. At the end of 1957, Publicis relocated its offices to the former Hotel Astoria at the top of the Champs-Élysées. In 1958, it opened the Drugstore on the first floor, which has since become a Paris landmark. In 1959, Publicis set up its department of “Industrial Information,” a forerunner of modern corporate communications.

From 1960 to 1975, Publicis grew rapidly, benefiting in particular from the beginnings of advertising on French television in 1968. The Boursin campaign inaugurated this new media: this was the first television-based market launch in France, and the slogan soon became familiar to everyone in the country: “Du pain, du vin, du Boursin” (“Bread, wine and Boursin”). Several months later, Publicis innovated again by siding with one of its clients in a new kind of battle: the defense of Saint-Gobain for which BSN had launched the first-ever hostile takeover bid in France.

In June 1970, 44 years after its creation, Publicis became a listed company on the Paris Stock Exchange.

However, on September 27, 1972, Publicis’ head offices were entirely destroyed by fire. A new building was built on the same site and the Company set about pursuing a strategy of expansion in Europe through acquisitions the same year, taking over the Intermarco network in the Netherlands (1972), followed by the Farner network in Switzerland in 1973; this resulted in the creation of the Intermarco-Farner network to support the expansion of major French advertisers in other parts of Europe. In 1977, Maurice Lévy was appointed Chief Executive Officer of Publicis Conseil, the Groupe’s main French business, after joining Publicis in 1971.

In 1978, Publicis set up operations in the United Kingdom after acquiring the McCormick advertising agency. In 1984, Publicis had operations in 23 countries across Europe. In 1981, Publicis opened a very small agency in New York.

In 1987, Marcel Bleustein-Blanchet decided to reorganize Publicis as a company with Supervisory and Management Boards. He became Chairman of the Supervisory Board, and Maurice Lévy was appointed Chairman of the Management Board. Since then, the strategy for Publicis has been defined by the Management Board and submitted to the Supervisory Board for approval; all operational decisions are made at the Management Board level.

In 1988, Publicis concluded a global alliance with the American firm Foote, Cone & Belding Communications (FCB) and the two European networks of the two partners merged. Publicis thus expanded its global presence with the help of its ally’s network.

Growth accelerated in the 1990s. France’s number four communications network, FCA!, was acquired by Publicis in 1993, followed by the merger of FCA! with BMZ to form a second European network under the name FCA!/BMZ. In 1995, Publicis terminated its alliance with FCB.

On April 11, 1996, Publicis’ founder died. His daughter, Élisabeth Badinter, replaced him as Chairman of the Supervisory Board. Maurice Lévy stepped up the Company’s drive to build an international network and offer clients a presence in markets around the world. The drive to acquire intensified and became global: first Latin America and Canada, then Asia and the Pacific, India, the Middle East and Africa. The United States was the scene of large-scale projects from 1998 onwards, as Publicis looked to significantly expand its presence in the world’s largest market. Publicis acquired Hal Riney, then Evans Group, Frankel & Co. (relationship marketing), Fallon McElligott (advertising and new media), DeWitt Media (media buying).

In 2000, Publicis acquired Saatchi & Saatchi, a business with a global reputation for talent and creativity. This acquisition was a milestone in the development of the Groupe in Europe and the United States. In September, Publicis Groupe was listed on the New York Stock Exchange. This same year, Publicis acquired Winner & Associates (public relations) and Nelson Communications (healthcare communication).

In 2001, Publicis Groupe formed ZenithOptimedia, a major international player in media buying and planning, by merging its Optimedia subsidiary with Zenith Media, which had previously been owned 50/50 by Saatchi & Saatchi and the Cordiant Group.

In March 2002, Publicis Groupe announced its acquisition of the US Group Bcom3, which controlled Leo Burnett, D’Arcy Masius Benton & Bowles, Manning Selvage & Lee, Starcom MediaVest Group and Medicus, and held a 49% interest in Bartle Bogle Hegarty. At the same time, Publicis Groupe established a strategic partnership with Dentsu, the leading communications Group in the Japanese market and a founding shareholder of Bcom3. The acquisition established Publicis Groupe in the top tier of the advertising and communications industry, making it the fourth largest advertising Groupe worldwide, with operations in more than 100 countries and five continents.

From 2002 to 2006, Publicis Groupe successfully integrated Bcom3, following Saatchi & Saatchi, and brought together a large number of entities. At the same time, it made a number of acquisitions to create a coherent range of services that would address clients’ needs and expectations, particularly offering different types of marketing services and access to the principal emerging markets. In late 2005, Publicis Groupe obtained its first official rating (“investment grade”) from the two leading international rating agencies, Standard & Poor’s and Moody’s. In late December 2006, Publicis Groupe launched a friendly tender offer for Digitas Inc., a leader in the digital and interactive communications sector in the United States and worldwide. This operation, which was completed in January 2007, was the first step in the Groupe’s remarkable advance into digital technology. At the time, the Groupe correctly foresaw the profound changes that the arrival of digital communications would have on the media world and, with the acquisition of Digitas, it immediately positioned itself as a market leader in that space. With the launch of “The Human Digital Agency” project, the Groupe clearly indicated its intention to integrate digital technology into the heart of its business, thereby reaffirming the desire and vision of its founder to make the Groupe a “pioneer of new technologies.”

During 2007 and 2008, Publicis Groupe undertook a profound reorganization of its structures and operational methods in order to adapt to the requirements of the digital era. It has thus added digital services to its well-known holistic service offer, while simultaneously pursuing the consolidation of its positions in fast-growing economies, both of which will be major challenges in the years to come. 2007 was the year of Publicis’ integration of Digitas Inc. This rapid and successful integration triggered a series of acquisitions in the digital domain in order to complete the Groupe’s global offer in the fields of interactive and Mobile Communication. 2008 and 2009 saw Publicis Groupe pursue the drive to develop in the fast-growing area of interactive communications and expansion into emerging markets.

In January 2008, Publicis Groupe and Google publicly announced a collaborative project. This collaboration, which began in 2007, is founded on a shared vision of using new technologies to develop the advertising business. The arrangement is not exclusive and is expected to complement other established partnerships with leaders in interactive media.

Amid brisk growth in the digital arena, the most visible sign of the Groupe’s transformation was undoubtedly the launch of VivaKi, a new initiative aimed at optimizing the performance of advertiser investments and maximizing Publicis Groupe’s market share growth. This initiative allows clients to reach precisely defined audiences in a single campaign and across multiple networks.

The global economic crisis in 2009, which saw numerous economies enter into recession and global trade shrink by 12%, did not hinder the development of Publicis Groupe’s strategy.

The acquisition of Razorfish – the number two interactive agency in the world after Digitas – from Microsoft in October 2009, brought new strengths to the Groupe’s digital activities, notably in e-commerce, interactive marketing, search engines, strategy and planning, social network marketing and the resolution of technological architecture and integration issues.

During 2009, Publicis Groupe and Microsoft entered into a global collaboration agreement defining three core objectives for the development of digital media. Microsoft’s and VivaKi’s respective teams will be able to provide clients with greater added value and effectiveness in all the domains of the digital sphere: content, performance, definition, targeting, and audience ratings.

In 2009, Publicis Groupe became the world’s third-largest communications firm, overtaking its competitor IPG. This position as number three has been considerably strengthened since then.

Thus, having confirmed the success of its strategy, in 2010 the Groupe continued its investments in digital activities and in developing areas of the world such as China, Brazil and India.

Despite the economic disruption in 2011, which was primarily due to sovereign debt in the eurozone and another financial crisis in August, followed by the United States’ debt rating downgrade, Publicis accelerated the development and implementation of its strategy, prioritizing digital businesses and developing countries. The Groupe acquired New York-based Big Fuel, the only agency specializing in social networks, thereby solidifying its position in the digital sector, and also acquired the Talent and DPZ agencies in Brazil and Genedigi in China.

During 2012, a difficult and uncertain year for growth, especially in Europe, Publicis Groupe continued to pursue an action plan that involved acquisitions and agreements designed to intensify the implementation of its strategic choices. The Groupe thus made a number of targeted acquisitions, particularly in the digital sector, in France, Germany, the United Kingdom, Sweden, the United States, Russia, Brazil, China, Singapore, India, Israel and, for the first time, in Palestine. Additionally, still in the digital arena, Publicis Groupe and IBM formed a global partnership based on their unparalleled influence on the future of e-commerce.

During 2013, Publicis Groupe actively pursued acquisitions, particularly in the digital sphere and across the globe, in order to achieve critical mass in various businesses, especially digital, and in the countries in which it already had a footprint, thereby leveraging scale. Having acquired LBi, the largest European independent marketing and technology agency, combining strategic, creative, media and technical expertise, the Groupe proceeded to combine it with the Digitas integrated global network, creating DigitasLBi, the world’s most complete digital network. It capitalizes on the seamless geographical integration of both entities: Digitas’ well-established position in the United States, LBi’s strong presence in Europe and the strong position of both networks in the Asia-Pacific region.

On July 27, 2013, Publicis Groupe and Omnicom Group Inc. signed an agreement for a merger of equals. In May 2014, Publicis Groupe chose not to pursue the merger with Omnicom Group Inc. With its unique position in the digital business, which offers growth prospects in a communications landscape upset by the rapid emergence of new technologies, the Groupe accelerated its development in innovative disciplines via the acquisition of several digital agencies and strategic partnerships.

In September, Publicis Groupe and Adobe formed a strategic partnership to offer the Publicis Groupe Always-On PlatformTM, the Groupe’s first comprehensive marketing management platform, which automates and centralizes all components of client marketing. This unique platform, anchored within VivaKi, available to all Publicis Groupe’s agencies and networks and standardized on Adobe Marketing Cloud, will enable, for the first time, all Publicis Groupe’s agencies to create attractive content, analyze their marketing, identify and create audience segments, deploy campaigns, as well as monitor and measure marketing performance using a common technology and data structure.

The most notable transaction of 2014 was the acquisition of Sapient, announced on November 3, 2014 and completed in early 2015. In an increasingly converged world, clients need a partner offering digital solutions to help them keep up with a connected, empowered consumer whose behavior has completely changed. The contribution of Sapient, combined with Publicis Groupe’s know-how in the digital area, creativity, media and brand communication, created unparalleled expertise in marketing and sales across all distribution channels and consulting services based on outstanding technological prowess.

Publicis Sapient is part of the new organization announced in 2015, aimed at structuring the Groupe in such a way that its clients are at the very heart of its organization. In the Groupe’s top 20 markets, major clients will each be assigned a Global Client Leader or a Country Client Leader, depending on the geographical scope of the support they require. In this way, the Groupe can offer the entire array of solutions to its clients: creative solutions through “Publicis Communications,” media solutions through “Publicis Media,” digital solutions through “Publicis Sapient,” and healthcare solutions provided by “Publicis Health.” For all other countries, a single structure called “Publicis One” combines all these solutions — creative, media, digital, healthcare — in each country.

Publicis Groupe is thus implementing the most integrated organization in the sector, for the benefit of its clients and employees alike. The new structure was rolled out over the first few months of 2016.

Publicis Groupe continued its tactical acquisitions strategy, with a view to completing its operational networks, both in expertise (content, commerce, behavioral analysis) and geographical scope (South Africa, Israel).

As announced at the end of 2015, the work to implement the new structure was completed by mid-2016. This structure abandons the holding Company model in order to develop a company operational architecture based on the Connecting Company concept. Highly modular in structure, the Connecting Company model of Publicis Groupe is unlike any other platform in its genre, and offers clients plug & play access to state-of-the-art services. It means a complete rethinking of our approach:

- ■make clients the priority ‒ the entire transformation of Publicis Groupe was designed and carried out in order to place our clients at the heart of our operations. Their requirements and objectives help us determine which solutions should be offered to them to ensure their success and growth;

- ■a fluid model ‒ just one person ‒ the Global Client Leader or Country Client Leader ‒ acts as the sole point of contact and account manager who can draw on our pool of almost 84,000 talents and break down silos, the legacies of the past and longstanding habits;

- ■working in harmony ‒ we have consolidated our income statements and removed all operational hurdles;

- ■modular organization ‒ the main advantage of our new structure is not just the depth and breadth of our capabilities, but above all our ability to adapt to any situation and to individual client requirements, with an open architecture that offers our global partners plug & play access where required;

- ■a comprehensive offering ‒ by bringing together our creativity, our intelligence and our technological expertise, we are able to present ideas to our clients on how to carry out their own transformations and ensure a consumer experience unlike that offered by any other agency or holding Company on the market.

Thus, Publicis connects all its expertise in an integrated way thanks to the “Power of One,” to provide winning solutions to its clients.

Two events that took place in 2016 have made Publicis’ history. The goal of the first, Viva Technology Paris, run in association with the Les Échos Group, was to stage a global event in Paris that would bring together start-ups and major stakeholders in the digital industry. This annual event is now a major event in Europe for global technology companies and start-ups. On its 90th anniversary, Publicis Groupe launched a project named Publicis90. This idea was to provide 90 projects or start-ups with financial aid and the support of the Groupe’s digital experts. After an initial phase of stringent selection over a period of several months, the winners were selected from among the 3,500 contestants from 130 countries and received their awards at a ceremony held during Viva Technology.

At the beginning of 2017, the Publicis Groupe Supervisory Board appointed Arthur Sadoun as Maurice Lévy’s successor as Chairman of the Management Board. Since June 1, 2017, Maurice Lévy has been a member of the Supervisory Board, which he now chairs.

2017 was marked by two themes: going further with integration and faster in the execution of the strategy prepared by Maurice Lévy. Our ambition is to become the leader in the convergence of marketing and operational transformations, through the alchemy of creativity and technology. For this, the Groupe has created two new decision-making entities, the Executive Committee and the Management Committee.

After breaking the silos and organizing itself into Solutions, the Groupe has gone a step further by implementing an organizational structure by country, with the aim of providing clients with a fully integrated offer, from advertising to marketing, consulting, and media, with data at its core. The deployment of this organization has begun in France, the United Kingdom, China and Italy.

Sprint to the Future, the plan for 2018-2020, was unveiled in March 2018. Built around its strategic game changers, namely data, dynamic creativity and digital business transformation, as well as its country organization, Publicis Groupe aims to become an indispensable partner in business transformation. These ambitions are matched by a sizeable investment plan, financed by a raft of cost-savings measures.

At the same time, Publicis Groupe looked to equip itself with a system that would serve its talent. The Marcel artificial intelligence platform, developed in partnership with Microsoft, and named in tribute to the group’s founder, Marcel Bleustein-Blanchet, was launched in May 2018. The aim of Marcel is to facilitate the transformation from a holding Company to a platform so that all Groupe employees worldwide can discuss and collaborate without barriers or borders.

2019 was a pivotal year for the Groupe with the acquisition of Epsilon, the marketing Big Data specialist. Epsilon has the technology and platforms to structure client first-party data, round it out with an incomparably diverse range of data sources and put together personalized campaigns at scale. Now more than ever, our activities are resolutely positioned to the future, with more than 30% of our net revenue generated by data and digital business transformation.

At the same time, the Power of One strategy, initiated in 2016, is now fully effective. Through the Groupe Client Leader, clients are offered a tailored service and direct access to the Groupe’s entire range of expertise. The Groupe helps its clients to constantly innovate and grow their sales, while controlling costs.

In 2019, the Groupe completed its transformation in terms of assets and structure. The Groupe is now in a unique position to serve clients across the entire value chain. It is the only one to have large-scale assets in creativity, media, data and technology.

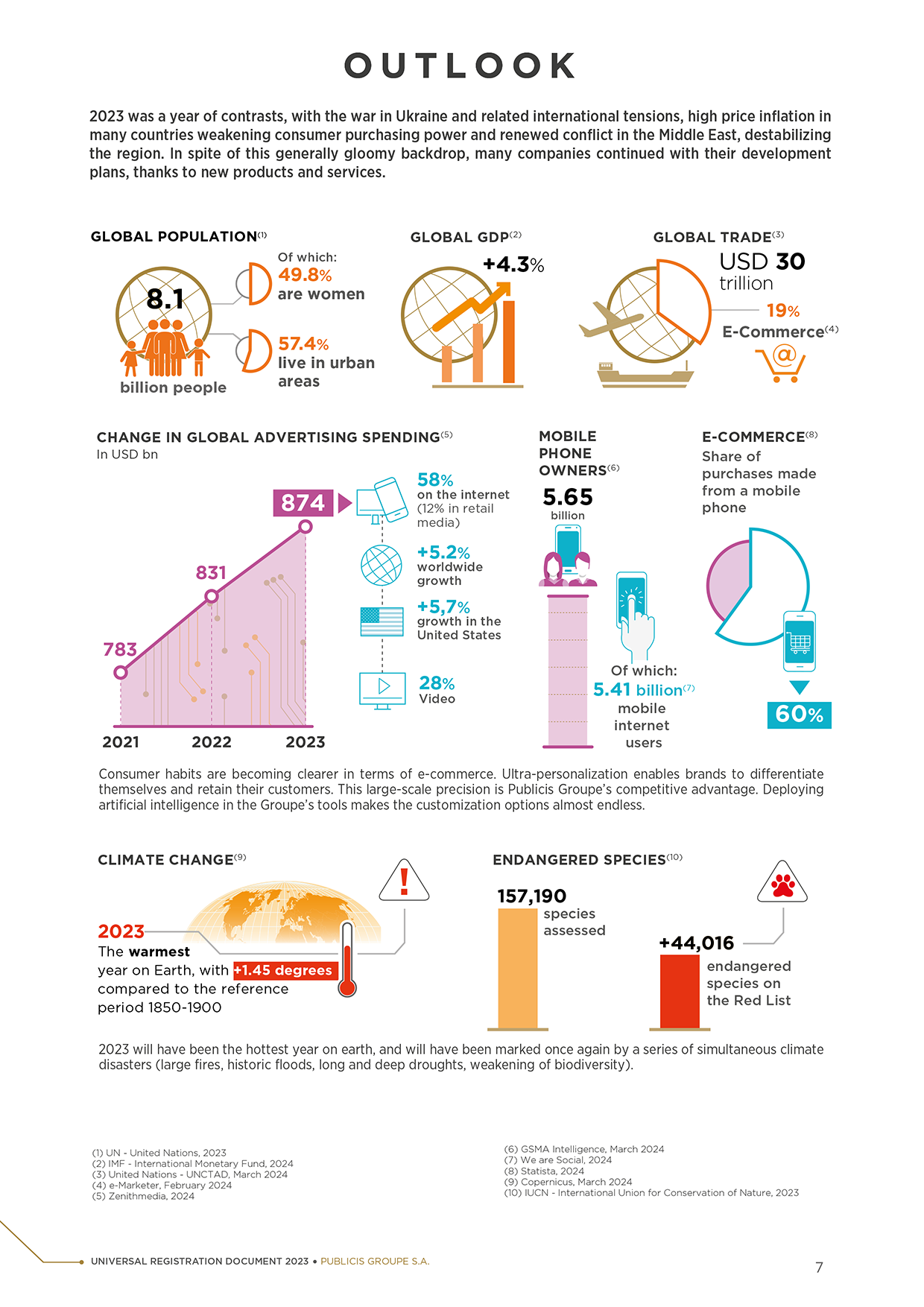

2020 was marked by the global Covid-19 pandemic, which affected all countries and sectors of activity for most of the year. This major health crisis resulted in one of the largest economic crises in recent history. The measures taken by various governments to contain this pandemic, such as lockdowns, have had a sudden and unprecedented impact on consumption and production.

The transformation that Publicis Groupe had initiated several years earlier enabled it to best meet the needs of its clients, to navigate alongside them in the crisis, define strategies to overcome it, accelerate their digital transformation and build direct links with their consumers. At the same time, the Groupe has taken important operational decisions to preserve its talent. The roll-out of Marcel, the Groupe’s artificial intelligence platform, has thus been accelerated to meet the requirements of new working methods and enable better sharing, even remotely. Marcel has acted as a way of bringing teams together and proved to be a valuable tool during such a period.

In such a context, the Groupe succeeded in delivering solid results thanks to the transformation undertaken several years earlier. Several factors were decisive in the Groupe’s performance: the Groupe’s investment in data and technology, with the acquisitions of Sapient and then Epsilon; its country organization, which enabled it to support its clients as closely as possible at each stage of the crisis and to provide a complete offer combining data, technology, media and creativity in an integrated manner; and its Marcel platform, which enabled the Groupe to adapt and act quickly by allocating resources efficiently.

2021 was exceptional in more than one aspect. Firstly, it saw a strong rebound in advertising spend globally, boosted by general economic growth and multiple stimuli from central banks and governments. It was also marked by the continuation of structural changes in the industry, in first-party data management, new digital media, the evolution of commerce and the digital business transformation. In this context, the Groupe acquired CitrusAd, the technological platform that optimizes the marketing performance of brands directly on e-commerce sites. Financially, the Groupe posted record results in 2021, with all indicators exceeding their 2019 levels.

The Groupe emerged from this pandemic both strengthened and ever more committed, as evidenced by the progress recorded this year in terms of ESG, which is reflected by taking first place, in our sector, in the rankings of eight of the top ten rating agencies.

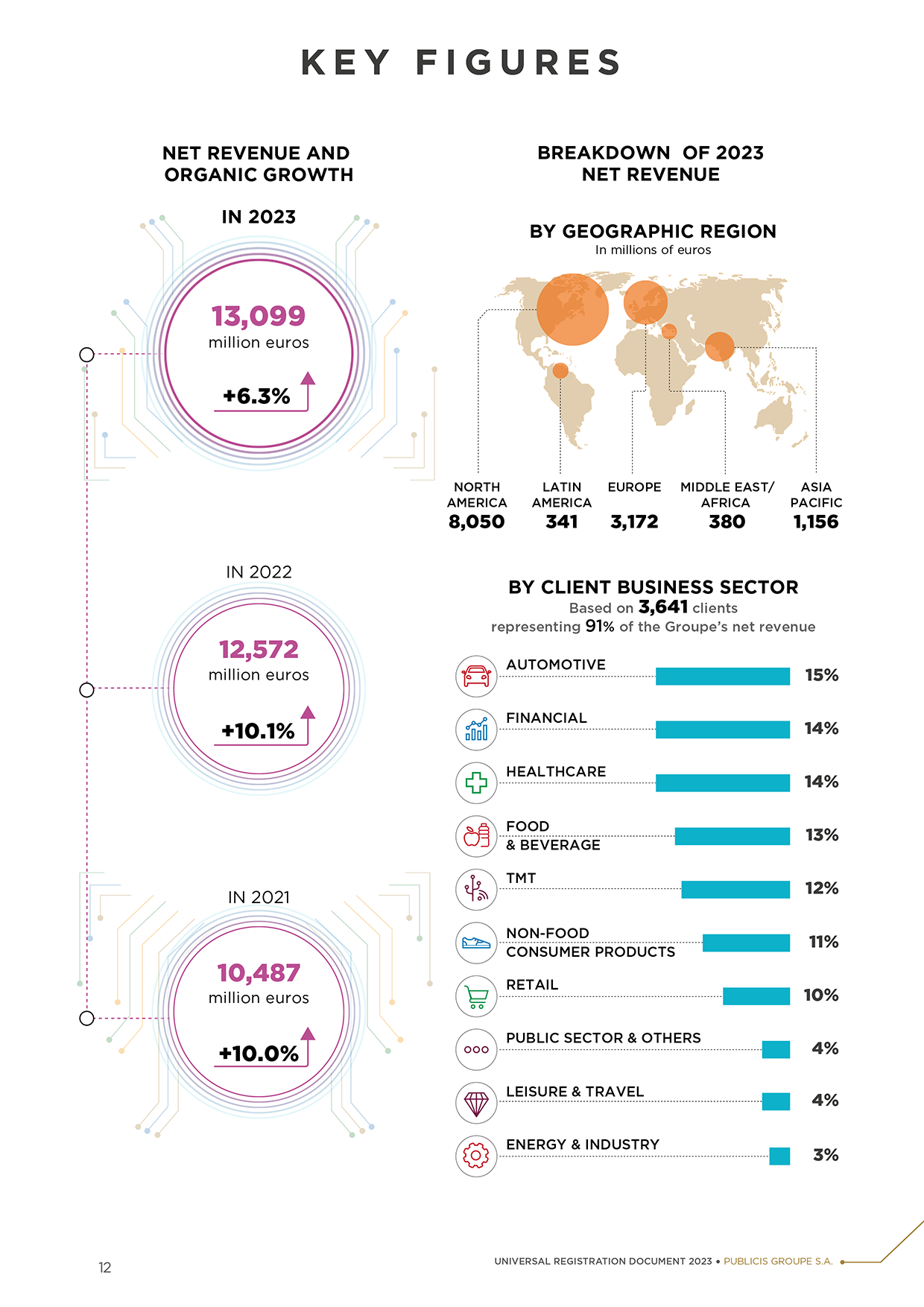

In 2022, the Groupe’s revenues exceeded euro 14 billion for the first time and net revenue euro 12 billion, driven in particular by double-digit organic growth for the second consecutive year. The Groupe made several acquisitions in the field of data (Retargetly in Latin America), commerce (Profitero) and expertise in digital transformation (Tremend). In addition, the Groupe announced the creation of a joint venture with Carrefour, Unlimitail to respond to the booming Retail Media market in Continental Europe and Latin America.

On the ESG front, the Groupe laid the foundations for a major initiative, #WorkingWithCancer, aimed at eradicating the stigma of cancer in the workplace, by supporting affected employees or those whose relatives are affected by the disease. Many companies have joined the project since the beginning of 2023.

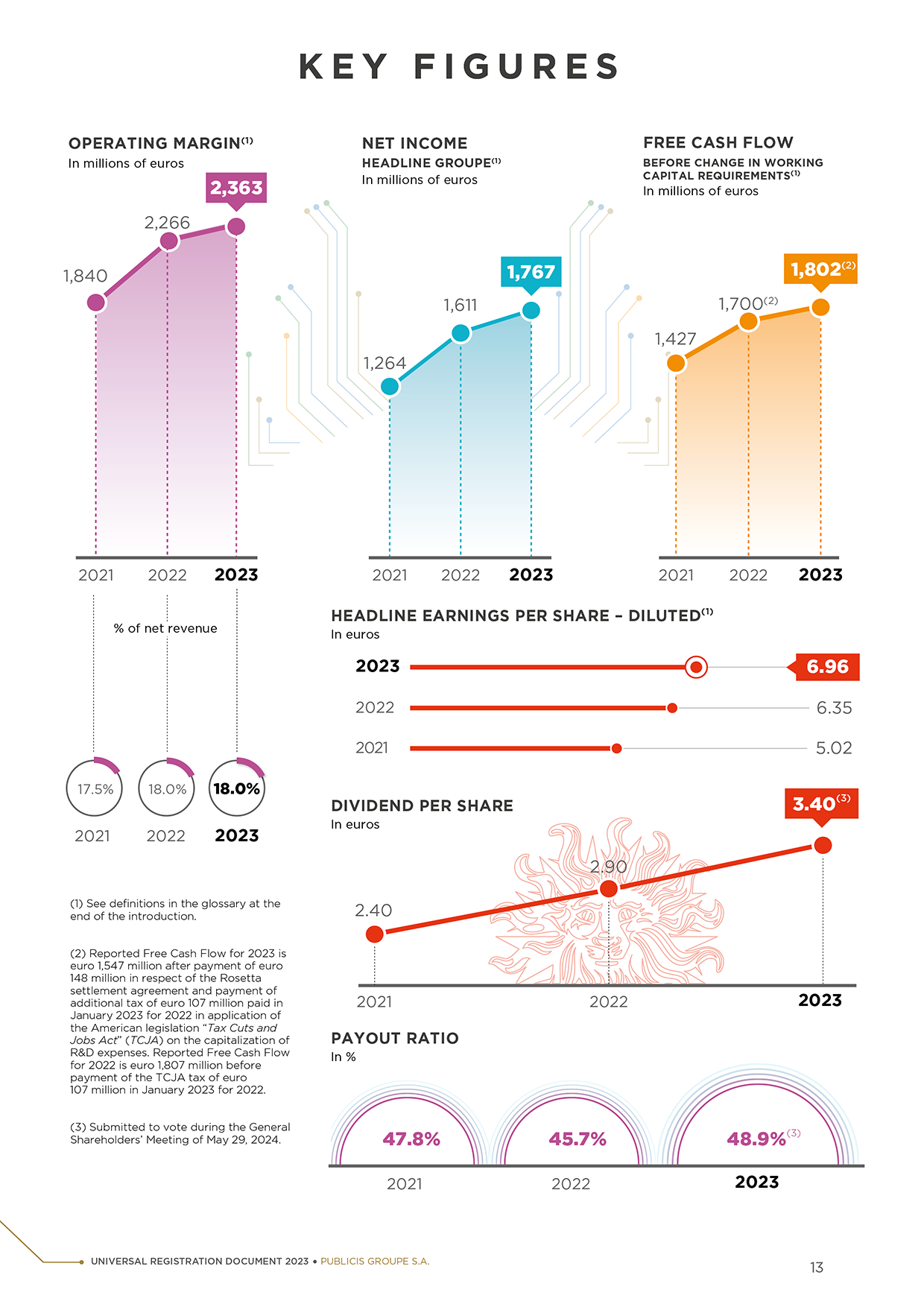

In a particularly difficult macroeconomic context, and after six years of transformation, Publicis clearly stood out in 2023, with a financial performance that far exceeded that of its competitors. With revenue of nearly euro 15 billion in 2023, Publicis reinforced its position as the second-largest player in the industry and the leading player in terms of market capitalization. During the year, the Groupe made several acquisitions: Yieldify in the field of technological marketing; Practia, one of the leaders in digital transformation in Latin America; and Corra, a leader in e-commerce recognized by Adobe as the one of the best companies in North America.

-

1.3Activities and strategy

1.3.1Introduction

Publicis is a world leader in marketing, communications and digital business transformation, established in 1926 when Marcel Bleustein-Blanchet created what was essentially a start-up.

The passion that Marcel felt for communications and the creation of strong relations between brand names and consumers transformed this new business into a prosperous and respected profession. The Groupe has never stood still, continuing to grow, innovate and transform for nearly 100 years. The core values dear to its founder’s heart have continued to define everything we do: respect, honest products, client satisfaction, quality and creativity, together with a pioneering spirit, unwavering conviction and the ethical values inherited from his legendary fighting spirit.

In 2023, the Groupe operates in more than 100 countries, has more than 103,000 employees and has become the second largest group in the global communications sector(1).

-

1.4Investments

Our investments focus on digital expertise, data and technology to strengthen our teams and promote innovation and the offer of new services. The strengthening of our agencies and the development of strategic partnerships and initiatives with major Internet players enables Publicis Groupe to anticipate the changes and evolution of communication industries towards digital technologies. The aim is to offer the most innovative solutions to our clients, in step with the rapid changes in consumer behavior and technologies.

1.4.1Main investments and divestments during the past three years

In 2021, Publicis announced the acquisition of CitrusAd, a Software as a Service (SaaS) platform optimizing brands' marketing performances directly within e-commerce websites, with headquarters based in Australia. CitrusAd’s expertise in e-commerce sites combined with Epsilon’s Retail Media offer for publishing sites, both powered by the CORE ID, enables Publicis Groupe to lead the new generation of identity-led Retail Media, with completely transparent performance measurement, validated directly by transactions. This acquisition was completed on September 1. While the growth of Retail Media is exponential, this acquisition aims to enable Publicis Groupe’s clients to accelerate their growth in this very dynamic sector. Clients will thus have complete visibility on the consolidated performance of their media investments and unparalleled access to first-party data from e-commerce sites, enabling them to prepare for a world without cookies.

Publicis also completed the acquisition of Boomerang in Benelux, strengthening its dynamic creativity and content offer for both local and global clients. Boomerang’s skills will contribute to strengthening the Groupe’s global Production capabilities, in particular Le Pub, and to the creation of a global center of excellence for Dynamic Creativity based in the Netherlands.

In December, Publicis announced the launch of SCB Tech X, a joint-venture between Publicis Sapient and Siam Commercial Bank (SCB), creating one of the largest fintech operators in Southeast Asia. The joint-venture started up with 1,200 employees and is 60% owned by SCB and 40% by Publicis Sapient. SCB Tech X is a cloud-native platform-as-a-service leader which serves clients in Southeast Asia, at a time when the total value of transactions in the digital payments market is expected to reach more than USD 1 trillion by 2025 in the region. SCB Tech X caters to retailers and consumers across the region and provides both innovative banking services, such as credit, current and savings, and non-financial services, ranging from meal delivery to health and well-being content, to online travel reservations.

Lastly, in December, the Groupe completed the acquisition of 100% of BBK Worldwide (United States), a full-service R&D marketing company and leader in clinical trials (CTE). BBK enables customers in the biotechnology and pharmaceutical industries to accelerate their R&D programs, advancing research through the unique integration of patient-centric services and proprietary technologies, thus complementing Publicis Health’s existing capabilities in CTE.

Total acquisition costs for entities integrated during 2021 (gross payments, after excluding cash and cash equivalents acquired) came to euro 276 million, including euro 103 million in earn-out payments. In addition, euro 14 million were disbursed for the payment of non-controlling interests.

In 2022, the Groupe made several acquisitions to strengthen its capabilities in Data, Digital Business Transformation and Commerce. In digital transformation, the Groupe acquired Tremend, a Company of 650 engineers and developers, founded 16 years ago and based in Bucharest (Romania), to develop the new Publicis Sapient global distribution center in Europe. The Groupe also acquired Tquila ANZ, one of the leading multi-cloud solution consulting firms in Australia, with the aim of strengthening the Salesforce expertise of Publicis Sapient. In Commerce, the Groupe acquired the SaaS platform Profitero. With 300 employees, this world leader in e-commerce intelligence enables brands to analyze and optimize their sales, marketing and operational performance on 70 million products sold online on more than 700 e-commerce sites worldwide. In Data, the Groupe acquired Retargetly and Yieldify and integrated them within Epsilon. Retargetly works with distributors and publishers to combine first-party data with partner data for personalized targeting and audience measurement on digital channels. This acquisition enabled Epsilon to launch its activities in Latin America. In addition, the acquisition of Yieldify strengthened the Epsilon offering with solutions that improve the personalization of sites and the optimization of conversions and the client experience.

Following the conflict between Ukraine and Russia, Publicis announced in March 2022 its withdrawal from Russia, with the transfer of control of its agencies to local management. The Groupe transferred control of its operations to Sergey Koptev, founding Chairman of Publicis in Russia, with a contractual commitment to ensure a future for its 1,200 employees in the country. Publicis stopped its business and investments in Russia, and the cession was effective immediately. This disposal, effective immediately, led to an exceptional loss on disposal of euro 87 million. Russia has been deconsolidated since April 1, 2022.

Total acquisition costs for entities integrated during 2022 (gross payments, after excluding cash and cash equivalents acquired) came to euro 523 million, including euro 119 million in earn-out payments. In addition, euro 49 million was paid out as part of the disposal of Russia (cash of divested entities).

In 2023, Publicis announced the acquisition of Practia, based in Buenos Aires, a leading Latin American independent technology company and provider of digital business transformation services. With its 1,200 experienced professionals, this acquisition will position Publicis Sapient to enter the Latin America market while establishing a foundation for a nearshore delivery platform that will enable the Company to better service clients based in North America.

Publicis also completed the acquisition of Publicis Sapient AI Labs, an innovative artificial intelligence research and development joint venture launched in 2020 in partnership between Publicis Sapient, Elder Research and Tquila. The acquisition will further strengthen Publicis Sapient’s data and AI capabilities, and enable the company to develop innovative solutions across industries for a wide range of applications, such as generative AI, Natural Language Processing (NLP), computer vision and autonomous systems.

In digital transformation, the Groupe acquired Corra, based in New York, a leader in e-commerce recognized by Adobe as one of the best e-commerce companies in North America. Corra will augment Publicis Sapient’s existing expertise in commerce solutions, including Adobe Commerce, while extending Publicis Sapient’s offerings in digital and omnichannel commerce. By acquiring Corra, Publicis Sapient will further establish itself as a global leader across the entire Adobe Product Suite, in addition to further cementing its already leading capabilities.

In June, Publicis and Carrefour announced the launch of their joint-venture Unlimitail to address the booming Retail Media demand in Continental Europe, Brazil and Argentina. Unlimitail will partner with retailers and brands, bringing unequaled scale, connectivity and consistency for Retail Media to reach its full potential in those regions. It is built on the most advanced technologies, “CitrusAd powered by Epsilon,” and the deepest retail expertise from Carrefour in the mass market retail sector. Unlimitail has already converted its first 13 retail partners, representing together more than 120 million loyalty customers.

Finally, in December, the Groupe announced the launch of PS Hummingbird, a joint venture with Tquila to expand Publicis Sapient’s generative AI offerings. PS Hummingbird operates as an independent entity and offers end-to-end services including strategy and planning, user experience and process design, data analysis, implementation, testing, training and long-term support.

-

1.5Major contracts

-

1.6Research and development

The Groupe does not believe that it is dependent on any specific patent or license to operate its businesses.

R&D within Publicis Groupe has always taken an applied form, as it is directly linked to the search for concrete technological solutions designed to help our clients, to developing and improving the performance of our products, technological platforms or internal tools, and to taking advantage of the latest technological advances to offer new options to our clients. Several PhD students work within the Groupe, most of them at Sapient and Epsilon.

At Epsilon, more than 70 PhD students in decision science are continuously optimizing the algorithms of our platforms to make them more precise, more powerful, and ultimately, more effective. A specific program hosts 15 PhD students for one year to monitor the work of the Decision Science teams.

Publicis Sapient has developed seven Labs in North America, Europe, India and Latin America, which are centers of technical expertise to respond in real time to clients’ technological issues. Our experts are available to answer client questions regarding the implementation of different platforms and the search for optimal solutions, and these teams can conduct Research & Development projects on behalf of clients to improve the performance of their tools or develop a new application environment (website, app, internal network). In addition, two recent initiatives enable the internal engineering community to work more effectively together. On the one hand, thanks to an internal collaboration platform several teams of engineers can cooperate simultaneously on the same project. On the other hand, it is an agnostic solution for the cloud, artificial intelligence/machine learning projects bring together engineers and data scientists in order to gain efficiency and speed for large-scale solutions. With the explosion of AI and Generative AI, Publicis Sapient’s expertise in this area is an asset in terms of innovation for clients, on how to use these new tools to improve products, services and user experiences. The skills spectrum covers Data Science, Data Strategy, Data Engineering and Data Analytics, which are partners in AI Accelerators and AI Labs, thus enabling rapid experimentation with new solutions. These teams also include Computer Science, Artificial Intelligence, Machine Learning, Mathematics, Physics and Engineering specialists.

Lastly, the Groupe’s Media activities invest significant resources in mathematical and statistical processing in order to best advise their clients in their media choices (particularly in terms of modelling the marketing mix or calculating the effectiveness of media actions), and many doctoral students are also part of these teams.

(1)Source = Competition – Section 1.3.7. -

2.Risk and risk management

2.1Main risk factors

The risk factors described below, together with the other information concerning Publicis Groupe and its consolidated financial statements included in this Universal Registration Document should be carefully considered before making an investment in the shares or other securities of Publicis Groupe. This section covers the main risks to which Publicis Groupe feels exposed to, as of the date of this Universal Registration Document. Each one of the risk factors may have a negative impact on the Groupe’s earnings and financial position as well as on its share price or financial instruments. Other risks and uncertainties of which Publicis is unaware of or which are not currently considered to be significant could also have a negative impact on the Groupe.

Description of the main risk factors

In accordance with the provisions of article 16 of Regulation (EU) 2017/1129, in each of the risk categories mentioned below, risks are presented in descending order of significance according to the Groupe's assessment at the date of this document. The risk factors considered the most significant are presented first, following an assessment of their potential impact and likelihood, after taking into account the mitigating measures implemented. The significance of the risks, as assessed by Publicis Groupe, may be amended at any time in light of changes in the Groupe's activities and circumstances.

-

2.2Internal control and risk management procedures

2.2.1Objectives and organization

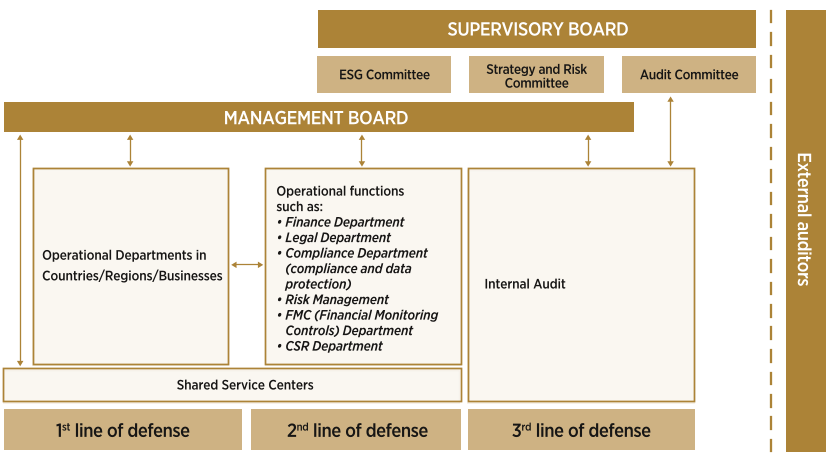

The internal control and risk management framework is fully integrated into the operational and financial management of the Groupe. Its remit extends across all the Groupe’s activities and structures. The Groupe internal control and risk management policy, which is regularly monitored by the Audit Committee and the Strategy and Risk Committee, approved by the Management Board and applied at all levels of the Groupe, is designed to provide reasonable assurance regarding the achievement of the Groupe’s objectives in relation to:

- ■the reliability of financial and non-financial information;

- ■compliance with applicable laws and regulations;

- ■the management of strategic, operational and financial risks;

- ■the efficacy and efficiency of operations, in line with the direction set by the Management Board.

The objectives of this framework, as approved by the Management Board and presented to the Audit Committee and Strategy and Risk Committee, are to enable:

- ■continuous monitoring aimed at identifying risks and opportunities having a potential impact on the achievement of the Groupe’s strategic, operational and financial objectives;

- ■appropriate communication about risks contributing to the decision-making process;

- ■regular monitoring of the effectiveness of the Groupe internal control and risk management framework.

The Groupe has a Secretary General function, which allows an organized and centralized monitoring of the activities that constitute the internal control framework. The Secretary General is a member of the Groupe’s Management Board. This function includes the Legal Department (managed by the General Counsel), the Internal Audit, Internal Control and Risk Management Department (managed by the VP of Internal Audit, Risk & Control), the Human Resources Department (compensation and employee benefits, human resources information system management, employee-related matters and mobility) and Corporate Social Responsibility (CSR). The Secretary General attends all meetings of the Strategy and Risk Committee. The Secretary General and the VP of Internal Audit Risk & Control attend all Audit Committee meetings and have easy access to its Chair and each of its members. Similarly, the Audit Committee has direct access to the Groupe’s risk management and internal control department. Expertise that enables a broader vision of risks and action levers are thus brought together, which supports the effort to improve risk management throughout the entire organization.

-

2.3Insurance and risk coverage

The insurance policy’s purpose, centrally managed within the Insurance Department, is to provide the best coverage for the Groupe's people and assets by achieving the right balance between local and corporate insurance coverage.

By implementing a two-tier insurance coverage (local and centralized), the Groupe strives to ensure complementarity of guarantees and thus better risk management across all the countries in which Publicis is present.

On a local level, mainly through the Re:Sources shared service centers, entities must purchase general liability, property damage and business interruption, automobile and employer’s liability insurance policies, as well as health and life insurance coverage for local employees. This insurance is taken out in compliance with the local regulations.

The only exception is the European zone: using the free provision of services framework in Europe, the Groupe has taken out a property damage and business interruption insurance policy and a general liability insurance policy which is available to all European subsidiaries.

At Groupe level, insurance programs have been implemented with leading insurance companies with the aim of automatically covering all subsidiaries against the financial consequences of risks such as, but not limited to:

- ■professional liability and cyber risks;

- ■director and officer liability;

- ■liability related to employment practices;

- ■general liability when terms and conditions or limits differ from the local insurance policies;

- ■property damage and business interruption when terms and conditions or limits differ from the local insurance policies;

- ■assistance and repatriation of employees during business travel.

In addition, the Groupe negotiates and sets up specific coverage that subsidiaries may subscribe to depending on their business needs, such as credit insurance, health and life insurance for expatriates and specific insurances for film and TV shoots.

The insurance policies are regularly reviewed to customize the coverage to any changes in our activity and, in particular, new digital services: the Groupe focuses particularly on this risk and its cyber-risk insurance coverage.

The amount of coverage is considered to be consistent with identified risk levels and with market practices.

In light of the Groupe’s significant Mergers and Acquisitions activity, the Insurance Department also oversees the integration of acquired entities within the Groupe’s program.

In June 2022, the Groupe set up Publicis Ré SA, a captive reinsurance Company within the meaning of article L.310-1-1 of the French Insurance Code. Publicis Ré is a wholly-owned French subsidiary dedicated to the reinsurance of the Groupe’s risks. It was approved on October 10, 2022 by the French Prudential Supervision and Resolution Authority (ACPR) to operate as a non-life reinsurer.

-

3.Governance and compensation

The report on corporate governance, within the competence of the Supervisory Board, includes information on the composition and functioning of management bodies, on compensation of corporate officers and on matters likely to be significant in the event of a public offer.

The information contained in the following developments is that mentioned in articles L. 225-37-4 and L. 22-10-10 of the French Commercial Code. Other information in the report, notably that mentioned in article L. 22-10-11 of the French Commercial Code, is listed in Section 10.8 of the Universal Registration Document “Cross-reference table for the corporate governance report”.

Publicis Groupe SA refers to the Afep-Medef Code as updated in December 2022. This Corporate Governance Code is available for consultation on the Afep website at www.afep.com.

3.1Governance of Publicis Groupe

The Company is a French joint-stock limited liability Company (société anonyme) with a Management Board (Directoire) and a Supervisory Board (Conseil de surveillance). The quality of its governance and compliance with the principles and rules governing its activities are central to the concerns of Publicis Groupe and the Supervisory Board.

Since 1987, the Groupe has had a dual governance system with both Management and Supervisory Boards, which was considered the best organization for Publicis Groupe. The quality of the Board’s work is ensured by the strong involvement of its members and facilitated by the role of five committees: a Compensation Committee, a Nominating Committee, a Strategy and Risk Committee, an Audit Committee and an ESG Committee (environmental, social and governance issues).

The members of the Management Board and Supervisory Board are collectively referred to as “corporate officers” in this document.

On June 1, 2017, Mr. Arthur Sadoun succeeded Mr. Maurice Lévy as Chairman of the Management Board of Publicis Groupe SA. On the same date, Mr. Maurice Lévy succeeded Mrs. Élisabeth Badinter as Chairman of the Supervisory Board. Mrs. Élisabeth Badinter was appointed Vice-Chair of the Supervisory Board on June 1, 2017.

In the interest of the Company and to ensure its sustainability, the Supervisory Board examines and decides on the main strategic orientations. It authorizes all transactions that have an impact on the Company’s capital and financial structure. The Supervisory Board has the power to appoint and dismiss members of the Management Board and to exercise permanent control over the management of the latter.

The Management Board is the Company’s collegial decision-making body. It is vested with the broadest powers to act in all circumstances on behalf of the Company that it represents vis-à-vis third parties. In accordance with the law, the Management Board is required to prepare a quarterly report on the Company’s business and submit it to the Supervisory Board for review. This report sets out the Groupe’s results, financial position, cash flow and human resources policy.

In the exercise of its powers, the Management Board submits to the Supervisory Board for the prior approval of the decisions that have a strategic impact on the Groupe, and in particular all decisions relating to significant transactions outside the strategy announced by the Company.

The Management Board and the Supervisory Board maintain a relationship of trust based on mutual respect for the prerogatives of each body as well as on an open and ongoing dialogue.

Mr. Arthur Sadoun, Chairman of the Management Board and Mr. Maurice Lévy, Chairman of the Supervisory Board, consult each other on the definition of the major strategic orientations and all significant events of the Company, benefiting from their respective knowledge of Publicis Groupe and its business sectors. Mr. Arthur Sadoun, regularly informs Mr. Maurice Lévy of the Company’s operations.

At the General Shareholders' Meeting on May 29, 2024, a proposal will be made to change the Company's management structure to that of a Board of Directors instead of the current dual structure with a Management Board and a Supervisory Board.

In this context, on April 17, 2024, the Supervisory Board approved the proposed changes to the Groupe's corporate governance structure and resolved to recommend the adoption of a Board of Directors structure in which Mr. Arthur Sadoun would act as Chairman and Chief Executive Officer (CEO).

The proposed new structure is described in more detail in Section 3.2 below and in the Management Board’s report.

3.1.1Supervisory Board

3.1.1.1Composition of the Supervisory Board as of December 31, 2023

The Supervisory Board is composed of at least three members and no more than 18 members. Members of the Supervisory Board are appointed by the General Shareholders’ Meeting. They serve four-year terms. The General Shareholders’ Meeting may nevertheless appoint or reappoint one or more members of the Supervisory Board for one-, two- or three-year terms with the sole aim of staggering their terms of office.

As of December 31, 2023, the Supervisory Board had 13 members, including two members representing employees appointed by the Groupe Works Council pursuant to article L. 225-79-2 of the French Commercial Code. Eight members are foreign national. It has 45% women and 55% men, and 64% are independent members, with the Board members representing employees not included in the calculation of these percentages, pursuant to the law and the Afep-Medef Code.

Gender parity on the Board(1)

Average age

Diversity(2)

Independent

members(1)(3)Average length of term of office

Employee representation

45% women/55% men

65 years

73%

64%

12 years

2 members

- ( 1 )In accordance with the law and the Afep-Medef Code, Board members representing employees are not included in the calculation of the minimum/maximum number of Board members, nor in gender quotas, nor for the number of independent members.

- ( 2 )Board members who are foreign nationals (excluding members representing employees).

- ( 3 )Members of the Supervisory Board qualifying as independent according to the Afep-Medef Code independence criteria.

Personal information

Experience

Position on the Supervisory Board

Meeting Attendance

Age(1)

Gender

Nationality

Number of Publicis Groupe SA shares held(1)

Total number of offices held in listed compa-

nies

Indepen-

dent member(2)First appointment

Year(s) on the Board

End of term of office

Member of the Audit Committee

Member of the Nominating Committee

Member of the Compen-

sation CommitteeMember of the Strategy and Risk Committee

Member of the ESG Committee

Maurice Lévy

Chairman of the Board

81

M

French

4,774,855

1

No

06/01/2017

6

GSM 2025

•

•

•

Élisabeth Badinter

Vice-Chair of the Board

79

F

French

16,700,967

1

No

11/27/1987

36

GSM 2026

✔

Simon Badinter

55

M

French and American

1,296

1

No

06/17/1999

24

GSM 2025

•

Jean Charest

65

M

Canadian

1,400

3

Yes

05/29/2013

10

GSM 2025

✔

•

Sophie Dulac

66

F

French

1,749,460

1

No

06/25/1998

25

GSM 2024

•

Thomas H. Glocer

64

M

American

500

3

Yes

05/25/2016

7

GSM 2024

•

•

•

Marie-Josée Kravis

74

F

American

2,914

2

Yes

06/01/2010

13

GSM 2024

•

✔

André Kudelski

63

M

Swiss

500

2

Yes

05/25/2016

7

GSM 2024

•

•

✔

Suzan LeVine

54

F

American

537

1

Yes

05/29/2019

4

GSM 2027

•

•

✔

Antonella Mei-Pochtler

65

F

Italian

500

3

Yes

05/29/2019

4

GSM 2027

•

•

•

Tidjane Thiam

61

M

French and Ivorian

700

3

Yes

05/25/2022

1

GSM 2026

•

•

Pierre Pénicaud

Member representing employees

60

M

French

0

1

n/a

06/20/2017

6

06/14/2025

•

Patricia Velay-

BorriniMember representing employees

55

F

French

50

1

n/a

10/16/2020

3

10/15/2024

•

•

M: male - F: female

n/a: not applicable

✔: Committee Chair

- ( 1 )As of December 31, 2023.

- ( 2 )Members of the Supervisory Board qualifying as independent according to the Afep-Medef Code independence criteria.

Changes to the composition of the Supervisory Board in 2023

The General Shareholders’ Meeting of May 31, 2023 resolved to renew the terms of office of Mrs. Suzan LeVine and Mrs. Antonella Mei-Pochtler as members of the Supervisory Board. These two terms of office will expire at the end of the Ordinary General Shareholders’ Meeting called to approve the financial statements for the 2026 financial year. The Supervisory Board meeting of May 31, 2023 also renewed their positions on the Supervisory Board Committees.

Presentation of the members of the Supervisory Board

The profiles below present members of the Supervisory Board, their respective experience and skills and the main offices and positions they hold or have held over the last five years, to the Company’s knowledge. The information below is as of December 31, 2023.

Maurice Lévy

- ●Chairman of the Supervisory Board

- ●Member of the Nominating Committee

- ●Member of the Strategy and Risk Committee

- ●Member of the Compensation Committee

Born on February 18, 1942,

of French nationalityFirst appointment: June 1, 2017

Expiry of term of office:

2025 Annual Ordinary General Shareholders’ Meeting

Number of shares held:

4,774,855

Publicis Groupe SA

133, avenue des Champs-Élysées

75008 Paris

FranceBiography

Maurice Lévy joined Publicis Groupe in 1971 as IT Director. In 1975, he was appointed Executive Vice-President of Publicis Conseil, the Groupe’s flagship, working his way up to his appointment as Chairman of the Management Board in 1987. He held this role for 30 years, until the General Shareholders’ Meeting of May 2017, when he was appointed as Chairman of the Supervisory Board of Publicis Groupe SA. He steered the accelerated globalization of the Groupe starting in 1996. In 2001, Publicis Groupe’s globalization picked up more steam with the acquisition of Saatchi & Saatchi, then Bcom3 (Leo Burnett, Starcom, MediaVest, etc.) in 2002. The move into the digital world began with the acquisition of Digitas (2006), followed by Razorfish (2009), and Rosetta (2011). The acquisition of Sapient in early 2015 opened new avenues for Publicis beyond its core business into marketing, omni-channel commerce and consulting.

Maurice Lévy co-founded the Institut français du Cerveau et de la Mœlle épinière (ICM) in 2005 and today chairs the Board of Directors of numerous organizations, including the Peres Center for Peace and Innovation, and, since October 2015, the Institut Pasteur-Weizmann. He has also received numerous distinctions for his work and his fight for tolerance. He is Commandeur de la Légion d’Honneur and Grand Officier de l’Ordre National du Mérite.

Other offices and positions held within the Groupe

None

Offices held outside the Groupe

- ●Chairman: L’Escalator SAS (France), Regicom Webformance SAS (France)

- ●Class A Director: Mora & F SA (Luxembourg)

- ●Founder and class A manager: Ycor Management SARL (Luxembourg)

- ●Founding Chairman: YourArt SAS (France)

Volunteer positions held outside the Groupe

- ●Member of the Global Advisory Board: Amundi SA, listed company (France)*

- ●Founding member and Director: Institut du Cerveau et de la Mœlle épinière (ICM) (Brain and Spine Institute) (France)

- ●Co-Chairman: Friends of the ICM Committee (France)

- ●Chairman: French Committee of the Weizmann Science Institute (association) (France)

- ●Chairman of the Board of Directors: Board of Pasteur-Weizmann (association) (France)

- ●Board member: The Weizmann Institute (Israel)

- ●Chairman: Les Amis Français du Peres Center for Peace and Innovation (endowment fund) (France)

- ●Chairman of the International Board of Governors: The Peres Center for Peace and Innovation (Israel)

- ●Trustee of the Appeal of Conscience Foundation (United States)

- ●Member of the Global Advisory Committee: Bank of America (United States)

Offices held outside the Groupe in the last five years

Offices listed above as well as the following office:

- ●Chairman of the Supervisory Board: Iris Capital Management SAS (France) (term ended in 2022)

Positions held outside the Groupe in the last five years

Positions listed above

* These positions are not included in the calculation of the number of offices held in listed companies (see table page 54 of this document).

Élisabeth Badinter

- ●Vice-Chair of the Supervisory Board

- ●Chair of the Nominating Committee

Born on March 5, 1944,

of French nationalityFirst appointment:

November 27, 1987Expiry of term of office:

2026 Annual Ordinary General Shareholders' Meeting

Number of shares held:

16,700,967

Publicis Groupe SA

133, avenue des Champs-Élysées

75008 ParisFrance

Biography

Élisabeth Badinter is the daughter of Marcel Bleustein-Blanchet, Publicis Groupe’s founder. She is a qualified philosophy teacher, specializing in the 18th century, and has also lectured at the École Polytechnique. Observer of the evolution of mentalities and mores, she has authored numerous essays. Élisabeth Badinter joined the Supervisory Board in 1987 and chaired it from 1996 to 2017.

Other offices and positions held within the Groupe

None

Offices and positions outside the Groupe

- ●Writer

- ●Chair: Eljud SAS (France), Judest SAS (France), Juzach SAS (France), Eliben SAS (France), Alba SAS (France), Vaba SAS (France), Elsi SAS (France)

- ●Chair of the Fondation Marcel Bleustein-Blanchet pour la Vocation (France)

Offices held outside the Groupe in the last five years

Offices listed above

SIMON BADINTER

- ●Member of the Supervisory Board

- ●Member of the Strategy and Risk Committee

Born on June 23, 1968,

of French and American nationalityFirst appointment: June 17, 1999

Expiry of term of office:

2025 Annual Ordinary General Shareholders’ MeetingNumber of shares held:

1,296Publicis Groupe SA

133, avenue des Champs-Élysées

75008 Paris

FranceBiography

Son of Élisabeth Badinter, Simon Badinter has successively served as Director of International Development (1996), member of the Management Board (1999-2013) and Chair (2003-2011) of Médias et Régies Europe, as well as Chair of Médias Regies America until 2013. Simon Badinter was in turn radio host of his show “The Rendezvous”, broadcast in 50 cities in the United States by Iheartradio and then, from 2017, volunteer coach for youth in detention in Ohio, a program which was extended to Kentucky and Pennsylvania in 2023, and a volunteer organizer of the Sing for Life program at the Akron Children's Hospital Behavorial Department in Ohio. In December 2022, the Ohio State Association of Juvenile Court Judges awarded him the Court Service Award in recognition of his overall work with troubled youth and service to the court system. He is also a member of the Board of Directors of Médiavision et Jean Mineur.

Other offices and positions held within the Groupe

- ●Director: Médiavision

et Jean Mineur SA (France)

Main offices and positions held outside the Groupe

- ●Director: BDC SAS (France)

- ●Counselor and coach (United States)

- ●Chair and Chief Executive Officer: Simbad Productions LLC (United States)

- ●Chief Executive Officer: Elsi SAS (France)

Offices held outside the Groupe in the last five years

Offices listed above

Jean Charest

- ●Independent member of the Supervisory Board

- ●Chair of the Audit Committee

- ●Member of the Nominating Committee

Born on June 24, 1958,

of Canadian nationalityFirst appointment: May 29, 2013

Expiry of term of office:

2025 Annual Ordinary General Shareholders’ MeetingNumber of shares held:

1,400Therrien Couture Joli-Coeur

1100 René Lévesque Boulevard West, Suite 2000,

Montreal (Quebec)

H3B 4A4

CanadaBiography

A trained lawyer, Jean Charest was elected to Canada’s House of Commons in 1984. At the age of 28, he was appointed Minister of State (Youth). He was also Minister for the Environment (leading the Canadian delegation at the Rio Earth Summit in 1992), Minister for Industry, Deputy Prime Minister of Canada then Prime Minister of Quebec from 2003 to 2012. He is currently a partner at Therrien Couture Joli-Coeur and a member of the Queen’s Privy Council for Canada.

Other offices and positions held within the Groupe

None

Main offices and positions held outside the Groupe

- ●Partner, senior lawyer and strategic advisor: Cabinet Therrien Couture Joli-Coeur (Canada)

- ●Chair of the Board of Directors: Ondine Biomedical, listed company (Canada)

- ●Member of the Advisory Board and member of the Canada US Borders Taskforce: Woodrow Wilson Center – Canada Institute (Canada)

- ●Member of the Advisory Board: Canadian Global Affairs Institute (Canada)

- ●Member of the Canadian Group of the Trilateral Commission (Canada)

- ●Chair: Canada ASEAN Business Council (Singapore)

- ●Member of the Supervisory Board and member of the Governance Committee: Tikehau Capital SCA, listed company (France)

- ●Member: Leaders pour la Paix (France)

- ●Permanent representative member: Chardi, Inc. (Canada)

- ●Co-Chair of the Board of Directors: Canada UAE Business Council (Canada)

- ●Member of the Advisory Committee: CelerateX (Hong Kong)

- ●Member of the Board of Directors: Historica Canada (Canada), Institute for Research on Public Policy (Canada)

Offices held outside the Groupe in the last five years

Offices listed above as well as the following offices:

- ●Chair of the Board of Directors: Windiga Energie (Canada) (term ended in 2022)

- ●Director: Canada Jetlines Operations Ltd, listed company (Canada) (term ended in 2022), Compagnie des Chemins de Fer nationaux du Canada, listed company (Canada) (term ended in 2022), Asia Pacific Foundation (Canada) (term ended in 2021), HNT Electronics Co Ltd (South Korea) (term ended in 2020)

Sophie Dulac

- ●Member of the Supervisory Board

- ●Member of the ESG Committee

Born on December 26, 1957,

of French nationalityFirst appointment: June 25, 1998

Expiry of term of office:

2024 Annual Ordinary General Shareholders’ MeetingNumber of shares held:

1,749,460

Dulac Cinémas

60, rue Pierre-Charron

75008 Paris

FranceBiography

Granddaughter of Marcel Bleustein-Blanchet and niece of Élisabeth Badinter. After several years in the public relations sector, Sophie Dulac, a psychographics graduate, continued her career by founding and managing a recruitment consultancy firm. Since 2001, she has chaired the cinema company, Les Écrans de Paris, now called Dulac Cinémas. She also manages the film production and distribution companies, Dulac Productions and Dulac Distribution. Since 2012, Sophie Dulac has been the founder and Chair of the Champs-Élysées Film Festival. Sophie Dulac was Vice-Chair of the Supervisory Board from 1999 to 2017.

Other offices and positions held within the Groupe

None

Main offices and positions held

outside the Groupe

- ●Chair: Dulac Cinémas SAS (France), Maison Dulac Cinéma SAS (France)

- ●Manager: Dulac Productions SARL (France), Dulac Distribution SARL (France), Marceau Media SARL (France)

- ●Vice-Chair of the Board of Directors: CIM de Montmartre (Association) (France)

- ●Chair: Association Champs-Élysées Film Festival (France)

Offices held outside the Groupe in the last five years

Offices listed above

Thomas H. Glocer

- ●Independent member of the Supervisory Board

- ●Member of the Audit Committee

- ●Member of the Compensation Committee

- ●Member of the Strategy and Risk Committee

Born on October 8, 1959,

of American nationalityFirst appointment: May 25, 2016

Expiry of term of office:

2024 Annual Ordinary General Shareholders’ MeetingNumber of shares held:

500

Angelic Ventures LP

335 Madison Avenue

New York, NY 10017

United StatesBiography

Thomas H. Glocer was a corporate lawyer at the law firm, Davis Polk & Wardwell, before joining Reuters in 1993. He was appointed CEO of Reuters Group in 2001 and then from April 2008 to December 2011, CEO of Thomson Reuters Corp.

He is currently Executive Chair of the Board of BlueVoyant Inc and Chair of the Board of Istari Global Ltd, companies specialized in cyber defense, and Executive Chairman of the Board of Capitolis Inc., specialized in financial technology. He was also General Partner at Communitas Capital LLC, a venture capital company, and member of the Boards of Directors of Morgan Stanley, Merck & Co and System Inc.

Other offices and positions held within the Groupe

None

Main offices and positions held outside the Groupe

- ●Founder and Managing Partner: Angelic Ventures LP (United States)

- ●Executive Chair of the Board: Capitolis, Inc. (United States), BlueVoyant Inc. (United States)

- ●Chair of the Board: Istari Global Ltd (United Kingdom)

- ●Director: Merck & Co., Inc., listed company (United States), Morgan Stanley, listed company (United States), K2 Integrity, Inc. (United States), Atlantic Council (United States), System Inc. (United States), International Tennis Hall of Fame (United States)

- ●General Partner: Communitas Capital LLC (United States)

- ●Member of the Board of Trustees: Cleveland Clinic (United States)

- ●Member: President’s Council on International Activities at Yale University (United States), European Business Leaders Council – EBLC – (Finland)

- ●Member of the Advisory Committee: Columbia Global Center, Paris (United States)

- ●Mentor: CMI (United Kingdom)

Offices held outside the Groupe in the last five years

Offices listed above as well as the following offices:

- ●Member of the International Advisory Group: Linklaters LLP (United Kingdom) (term ended in 2023)

- ●Director: Reynen Court LLC (United States) (term ended in 2022)

Marie-Josée Kravis

- ●Independent member of the Supervisory Board

- ●Chair of the Strategy and Risk Committee

- ●Member of the Nominating Committee

Born on September 11, 1949,

of American nationalityFirst appointment: June 1, 2010

Expiry of term of office:

2024 Annual Ordinary General Shareholders’ MeetingNumber of shares held:

2,914

625 Park Avenue

New York, NY 10065

United StatesBiography

Marie-Josée Kravis is an economist specializing in the analysis of public policy and strategic planning. She began her career as a financial analyst at Power Corporation of Canada and then worked for the Solicitor General of Canada and the Canadian Ministry of Public Services and Procurement. She was Vice-Chair of the Board of Directors and Senior Researcher at the Hudson Institute.

Other offices and positions held within the Groupe

None

Main offices and positions held outside the Groupe

- ●Chair Emeritus and Chair of the Board of Directors: Museum of Modern Art of New York – MoMA (United States)

- ●Director: LVMH Moët Hennessy-Louis Vuitton SA, listed company (France), The Bretton Woods Committee (United States)

- ●Vice-Chair of the Board and member of the Executive Committee: Memorial Sloan Kettering Cancer Center (United States)

- ●Chair of the Board of Directors: Sloan Kettering Institute (United States)

- ●Journalist

- ●Chair Emeritus: The Economic Club of New York (United States)

Offices held outside the Groupe in the last five years

Offices listed above as well as the following offices:

- ●Member of the International Advisory Committee: The Federal Reserve Bank of New York (United States) (term ended in 2023)

- ●Vice-Chair of the Board of Directors and Senior Researcher: Hudson Institute (United States) (term ended in 2021)

André Kudelski

- ●Independent member of the Supervisory Board

- ●Chair of the Compensation Committee

- ●Member of the Audit Committee

- ●Member of the Nominating Committee

Born on May 26, 1960,

of Swiss nationalityFirst appointment: May 25, 2016

Expiry of term of office:

2024 Annual Ordinary General Shareholders’ MeetingNumber of shares held:

500Kudelski SA

22-24, route de Genève

PO Box 134

1033 Cheseaux-sur-Lausanne SwitzerlandBiography

André Kudelski is the Chair of the Board and CEO of the Kudelski Group, a world leader in digital security, listed on the Swiss Stock Exchange (SIX: KUD.S). Holding a master’s in applied physics from the École Polytechnique Fédérale de Lausanne (EPFL), he began his career with the Kudelski Group in 1984 as an R&D engineer, before becoming a Director of Nagravision, the digital TV arm, in 1989. In 1991, he succeeded his father, Stefan Kudelski, the company’s founder, as Chair and Deputy Director. André Kudelski is also Chair of the Board of Directors of Innosuisse, the federal Swiss Innovation Agency, as well as Vice-Chair of the Board of Directors of the Swiss-American Chamber of Commerce. He sits on the Strategic Advisory Board of the EPFL and has previously served as Vice-Chair of the Board of Directors of Geneva International Airport. He also was Director of Nestlé, HSBC Private Banking Holdings (Switzerland), Edipresse and Dassault Systèmes. André Kudelski has received numerous distinctions, including the title of Global Leader for Tomorrow from the World Economic Forum in 1995 and an Emmy® Award in 1996 from the National Academy of Arts and Sciences, recognizing his work in controlling access to television.

Other offices and positions held within the Groupe

None

Main offices and positions held outside the Groupe

- ●Chair and Deputy Director: Kudelski SA, listed company (Switzerland)

- ●Deputy Manager: Nagravision Sàrl (Switzerland)

- ●Chair of the Board of Directors: Innosuisse (public law) (Switzerland), Restaurant de l’Hôtel de Ville de Crissier SA (Switzerland), Montreux Media Venture (Switzerland)

- ●Co-Chair: NagraStar LLC (United States)

- ●Chair and Chief Executive Officer: Nagra USA, LLC. (United States), Kudelski Corporate, Inc. (United States), Kudelski Security Holdings, Inc. (United States), Open TV, Inc. (United States), Kudelski Security, Inc. (United States)

- ●Vice-Chair: Swiss-American Chamber of Commerce (association) (Switzerland)

- ●Chair: Fondation du Festival de Jazz de Montreux (Switzerland)

- ●Member of the Supervisory Board: Skidata GmbH (Austria)

- ●Director: Sunset Music SA (Switzerland), Greater Phoenix Economic Council (GPEC) (not-for-profit company) (United States)

- ●Member of Committee: Économiesuisse (association) (Switzerland)

- ●Member of the Strategy Advisory Board: Foundation of the École Polytechnique Fédérale de Lausanne (Switzerland)

- ●Member of the Foundation Board: Fondation Cinémathèque Suisse (Switzerland), Venture Foundation (Switzerland), Swiss Digital Initiative Foundation (Switzerland)

- ●Member of the Steering Committee: Foundation Bilderberg Meetings (Netherlands)

- ●Council Member: STS Forum (Japan)

- ●Chair of the Foundation Board: Foundation for the Support of Research and Development of Oncology (Switzerland)

- ●Member of the Advisory Council: Swiss Board Institute (foundation) (Switzerland)

- ●Member of the Swiss Higher Education Council (public law) (Switzerland)

Offices held outside the Groupe in the last five years

Offices listed above as well as the following offices:

- ●Director: Automotive Trade Finance SA (Switzerland) (term ended in 2023), RSH Quality Food Concept SA (Switzerland) (term ended in 2022)

- ●Chair and Deputy Director: Nagra Plus SA (Switzerland) (term ended in 2021)

- ●Chair of the Board of Directors: SmarDTV SA (Switzerland) (term ended in 2019)

Suzan LeVine

- ●Independent member of the Supervisory Board

- ●Chair of the ESG Committee

- ●Member of the Audit Committee

- ●Member of the Nominating Committee

Born on November 17, 1969,

of American nationalityFirst appointment: May 29, 2019

Expiry of term of office:

2027 Annual Ordinary General Shareholders’ MeetingNumber of shares held:

5371535 9th Avenue West

WA 98119 Seattle

United States

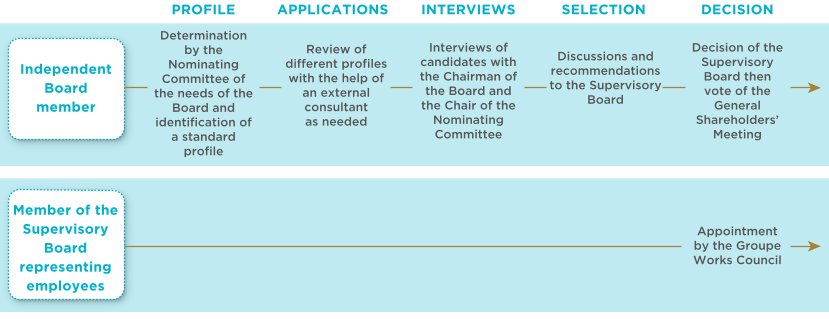

Biography