URD 2024

-

MESSAGE FROM THE EMERITUS CHAIRMAN

When I took the initiative of launching a review of Publicis Groupe’s governance, which led to a revision of our Articles of Incorporation and the appointment of Arthur Sadoun as Chairman and CEO, it was with the aim of giving the Groupe the means to sustain a strong and stable governance conducive to its development and growth. The aim was to ensure that responsibilities remained concentrated in safe hands while enabling a smooth transition to a promising future.

“The alchemy between data, technology and creativity in a rapidly changing world has created a breeding ground for the acceleration of artificial intelligence. In 2024, Publicis committed to an investment of 100 million euros in AI, as part of a larger plan of 300 million euros over three years.”

“This legal transformation, which was carried out as planned, is an essential lever for all Publicis stakeholders: our clients, our partners, our employees and our shareholders.”

Arthur Sadoun emphasized that this was a way of continuing our collaboration in tandem. This was not only a legal or formal decision, but rather an operational and symbolic initiative. This approach, which has borne fruit in recent years, has enabled us to maintain close collaboration and successfully bring our projects to fruition. With this change, the ultimate responsibility of the company now rests on his shoulders. And it is undeniable that Publicis has had an exceptional track record. Seeing how records have been systematically broken, whether in terms of growth, new contracts or margins, is a source of pride. But beyond these impressive figures, the Company now has solid assets that have been strengthened, offering unique services to our clients and promoting their profitable growth.

The alchemy between data, technology and creativity in a rapidly changing world has created a breeding ground for the acceleration of artificial intelligence. In 2024, Publicis committed to an investment of 100 million euros in AI, as part of a larger plan of 300 million euros over three years. This investment is in addition to the 10 billion euros already spent over the last eight years, most notably in the strategic acquisitions of Epsilon and Sapient. More broadly, this development is unfolding in a rich and astonishing manner, manifesting itself in our agencies, in daily support for our employees with Marcel, and in the production of individualized messages. And tomorrow, with CoreAI, AI will extend to the entire Groupe, optimizing the performance of our campaigns and increasing the productivity of our teams.

“Publicis Conseil was named Agency of the Year at the Cannes Lions for the first time in its history, a testament to the agency’s continued excellence.”

This legal transformation, which was carried out as planned, is an essential lever for all Publicis stakeholders: our clients, our partners, our employees and our shareholders. It was the key to a series of remarkable professional performances. For example, Publicis Conseil was named Agency of the Year at the Cannes Lions for the first time in its history, a testament to the agency’s continued excellence. Publicis Luxe was awarded the first Lion d’Or in the luxury category. In addition, Marcel’s La Compil des Bleues campaign for Orange was a real triumph, becoming the world’s most award-winning campaign. These awards highlight not only the Groupe’s creativity but also its societal commitment.

“The strength of our balance sheet, continuous innovation and the depth of our services will ensure that Publicis will get through this period, as we have done in the past when faced with far more complex challenges, and always in keeping with our values.”

The Working with Cancer program that we launched has had a tremendous impact in just two years. With its goal of breaking the stigma of cancer in the workplace, it has reached over 35 million employees in 2,500 companies worldwide. This success reflects Publicis’s deep commitment to the well-being of its employees and the fight against the disease, and it is part of our global health and prevention initiative.

More pragmatically, this success is also reflected in our numbers: on December 31, our share reached an all-time high of 103 euros. Of course, the macroeconomic turbulence that is battering the market will affect our stock market performance, but the strength of our balance sheet, continuous innovation and the depth of our services will ensure that Publicis will get through this period, as we have done in the past when faced with far more complex challenges, and always in keeping with our values.

-

MESSAGE FROM THE CHAIRMAN AND CEO

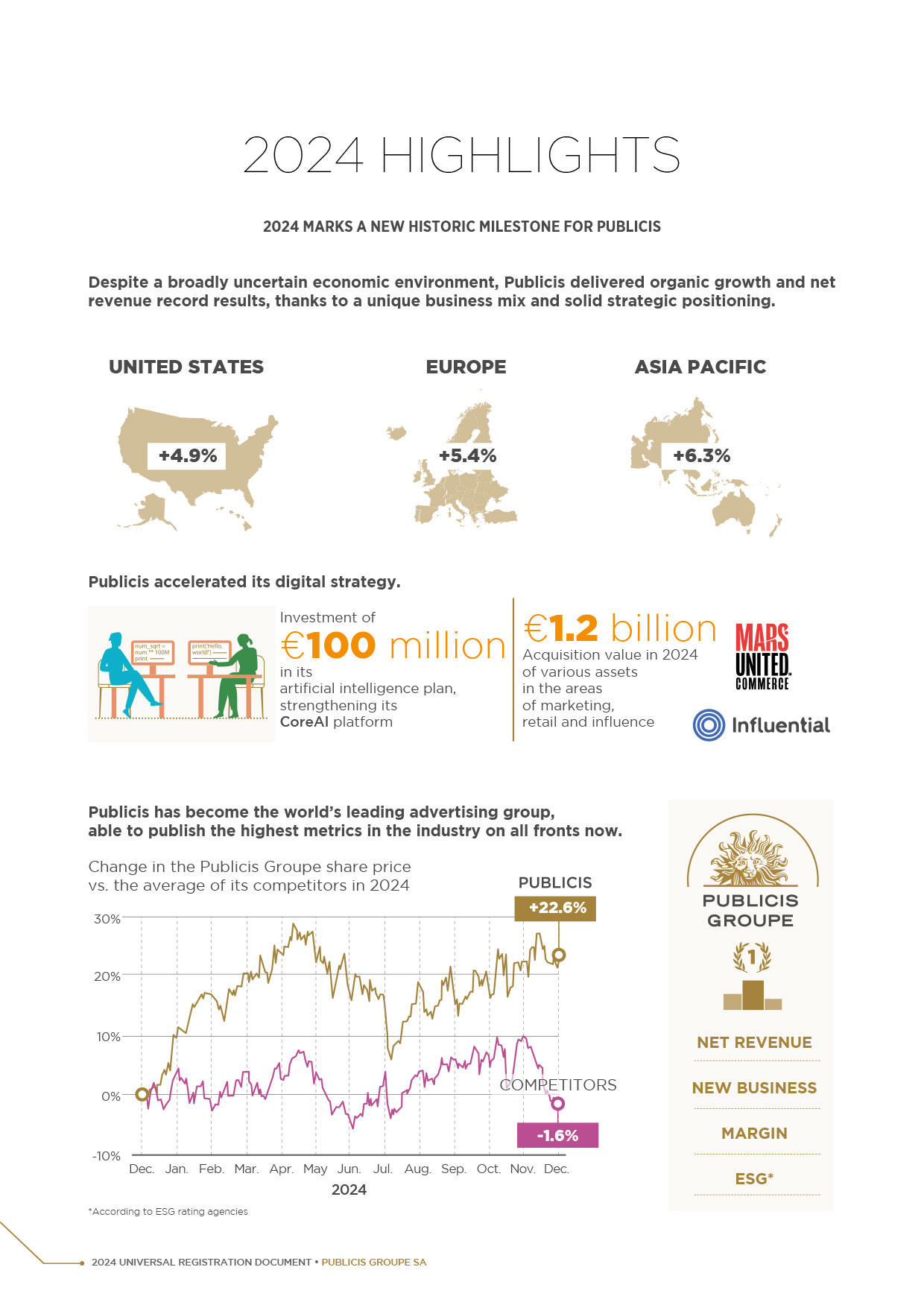

Publicis Groupe is reaping the rewards of Maurice Lévy’s vision and the execution efforts of all our teams. After having been number 1 in organic growth for three years, in new business for five years, in financial ratios for more than ten years, and in market capitalization since 2023, Publicis has become the world’s leading communications group.

Publicis has radically transformed itself over the past decade, moving from being a partner in our clients’ communications to being an essential partner in their transformation. We have built a status as a Category of One thanks to our unmatched first-party data capabilities, our connected media ecosystem, our creative firepower, and our more than 25,000 engineers, brought together through the Power of One.

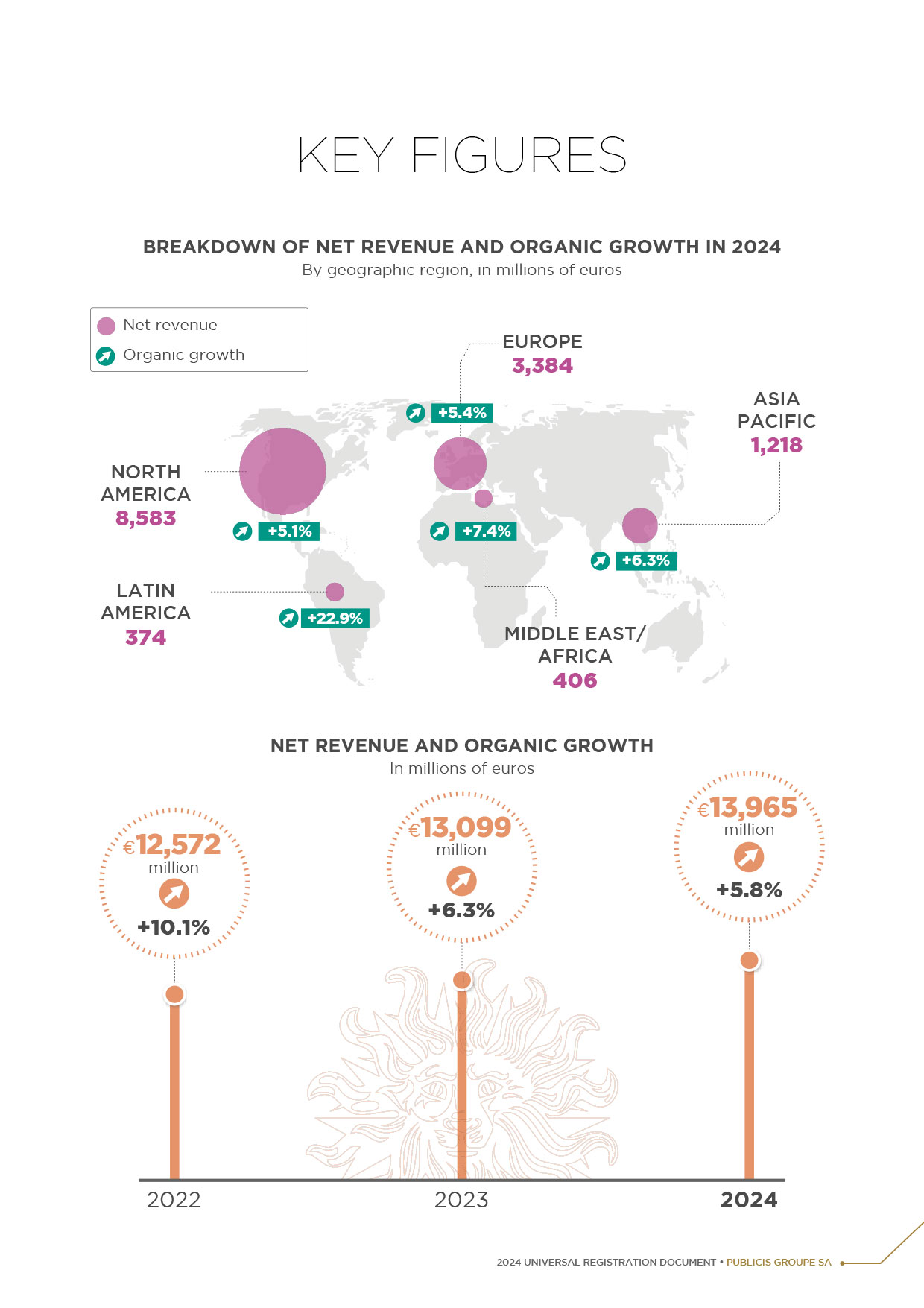

In an environment that remained challenging, organic growth in net revenue was +5.8%, accelerating compared to the average growth rate since 2020. We are ending the year growing three times faster than our holding company peers, and five times faster than the IT consultancies. This outperformance is mainly due to our unique positioning, with data forming the backbone of our Connected Media, and to our ongoing drive to win market share. Our creative agencies regrouped within Intelligent Creativity have shown resilience in the face of budget cuts across the traditional advertising sector. Publicis Sapient still encounters a wait-and-see attitude from some clients with regard to their digital transformation projects, a situation that is generally affecting all the major players on the IT consulting sector.

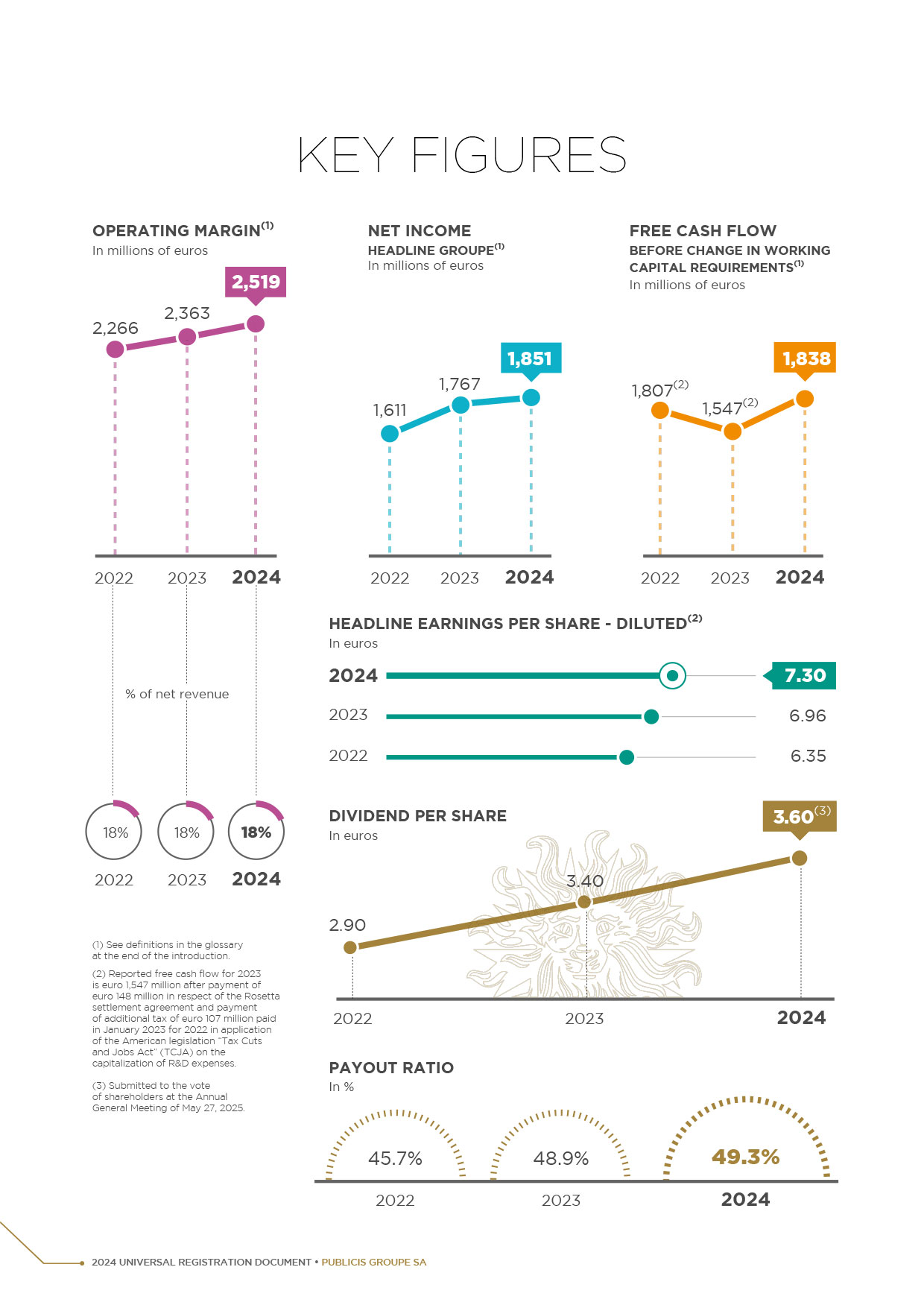

In addition to outperforming in terms of organic growth, the Groupe posted the highest financial ratios in our industry, with an operating margin of 18% and adjusted free cash flow of over 1.8 billion euros, while accelerating our investments in AI and talents.

“2024 was also a year of accelerated acquisitions, enabling us to strengthen our lead in the industry thanks to our unique model.”

2024 was also a year of accelerated acquisitions, enabling us to strengthen our lead in the industry thanks to our unique model. We invested 1.2 billion euros in acquiring Influential, the world’s largest influencer marketing platform, and Mars United Commerce, the #1 independent commerce marketing company. We are now clearly leading on 3 critical expertise for our clients: addressable media, creators and commerce. We are then able to directly link this expertise with Epsilon’s identities around the world to create a connected media ecosystem that we can build transparently within our clients’ proprietary environments.

These very solid results will allow us to propose to our shareholders at the General Shareholders’ Meeting of May 27, 2025, dividend to be paid entirely in cash, of 3.60 euros per share—an increase of 5.9%—and a payout ratio of 49.3%, the highest in our industry.

I cannot write these words without mentioning the economic uncertainty at the start of 2025. Many of our customers are facing very difficult situations due to price wars, rising inflation and a geopolitical environment that is more unstable than ever. And more than ever, we will be at their side to support them in these uncertain times.

Our performance in the first quarter as well as the record level of new business gains in the first months of 2025 give us confidence in the Groupe’s ability to post strong growth in 2025. Our model allows us to anticipate organic growth of between +4% and +5% in 2025. At the same time, Publicis Groupe will continue to post the best financial ratios in the sector with an expected operating margin up slightly from the record level of 18% in 2024, and a free cash flow before change in working capital of between 1.9 and 2 billion euros.

“Our performance in the first quarter as well as the record level of new business gains in the first months of 2025 give us confidence in the Groupe’s ability to post strong growth in 2025.”

I would like to thank the Board for its unwavering support and especially Elisabeth Badinter, Vice-Chair of the Board, and Maurice Lévy, Emeritus Chairman, whose pioneering visions and investments have enabled the Groupe to position itself to face a future dominated by artificial intelligence. In 2024 more than ever, his experience and knowledge of the sector were valuable assets.

-

GLOSSARY

Advanced TV: Advertising medium in which ads are shown in programs and films broadcast via over-the-top (OTT) services on connected TVs (with a built-in Internet connection) or streaming devices.

Digital Business Transformation (DBT): Consulting services in the transformation of our clients’ business models and their adaptation to the digital world.

Direct-to-consumer brands: Brands selling directly to consumers over the Internet without going through physical distributors.

Dynamic creativity: Personalized creative content adapted to the consumer according to their characteristics (location, interests, stage in their consumer journey, etc.).

Epsilon CORE ID: The market-leading privacy-safe person-based identifier, designed to help brands accurately recognize and reach consumers across the open web.

Epsilon PeopleCloud: Platform powered by Epsilon’s CORE ID to enable personalized consumer journeys at scale. The platform allows brands to manage and grow their client data, engage with consumers across channels and measure marketing spend to optimize best outcomes.

Global Delivery Centers: Hubs bringing together Publicis Groupe employees available to support the country model, particularly in media, production, data and digital transformation expertise.

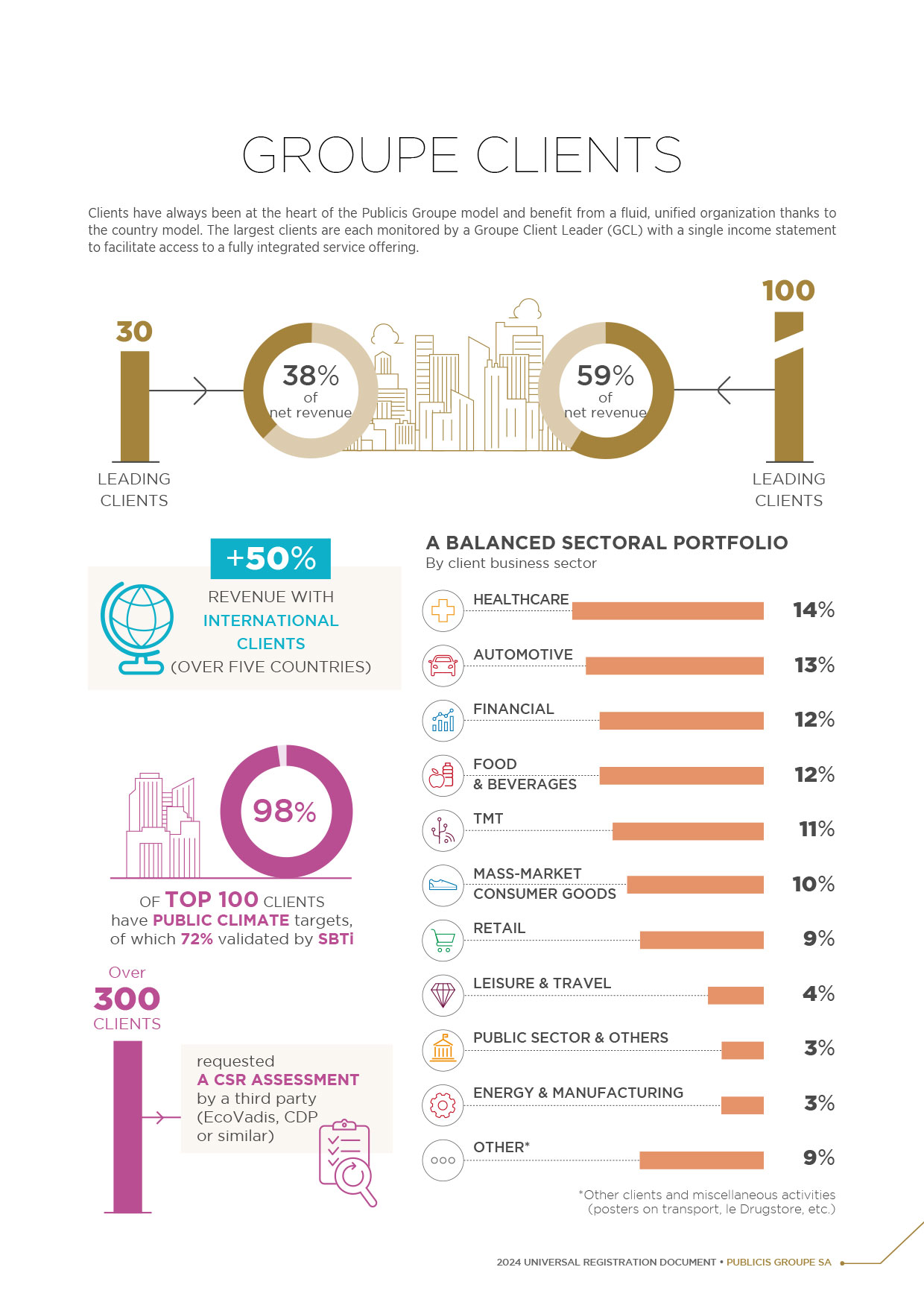

Groupe Client Leaders (GCL): The Groupe Client Leader is responsible for all services and skills made available to the client, regardless of the discipline. GCLs have a geographical scope that can be global, regional or country-based.

Industry verticals: Organization of certain Groupe activities according to the clients’ business sector.

JANUS: the body of rules of conduct and ethics that applies to all Groupe employees and establishes the rules of business conduct: “The Publicis way to behave and operate”.

Platform: Service acting as an intermediary to access information, content, services or goods, most often published or provided by third parties. It organizes and prioritizes content and generally responds to its own ecosystem approach.

Publicis Communications: Until the end of 2019, Publicis Communications brought together the Groupe’s global creative offering, including Publicis Worldwide, Leo Burnett, Saatchi & Saatchi, BBH, as well as Prodigious, a world leader in production, Marcel, Fallon and MSL, a specialist in strategic communication. As of early 2020, this structure no longer exists at the global level as the Groupe has moved to a country organization. It continues to exist in the United States, reflecting the organization’s adaptation to the size of the country. Publicis Communications US has also included Razorfish, a digital marketing activity, since 2020.

Publicis Media: Until the end of 2019, Publicis Media brought together all of the Groupe’s media expertise, specifically the investment, strategy, analyses, data, technology, marketing performance and content of Starcom, Zenith, Spark Foundry, Blue 449, Performics and Digitas. As of early 2020, this structure no longer exists at the global level as the Groupe has moved to a country organization. It continues to exist in the United States, reflecting the organization’s adaptation to the size of the country.

Publicis Sapient: Publicis Sapient partners with clients in the field of digital business transformation, based on technology, data, digital and consumer experience.

Re:Sources: Re:Sources includes the Shared Service Centers, which cover most of the required administrative functions for the Groupe’s agencies.

Retail media: Purchase and sale of advertising on retailers’ websites and apps, most commonly in sponsored product ad format and based on retailer transactional data.

The Power of One: A unique offering made available to clients by simply, flexibly and efficiently providing all of Publicis Groupe’s expertise (creative, media, digital, tech, data and health).

Viva Technology: Event co-organized by the Groupe, Les Echos and Publicis Groupe. This is the first international meeting dedicated to innovation, the growth of start-ups and collaboration between large groups and start-ups in France.

Walled garden: Expression generally used to designate the advertising ecosystems of a few digital giants in which advertisers have only limited access to data and information.

Capex: Net acquisitions of tangible and intangible assets, excluding financial investments and other financial assets.

CCPA: The California Consumer Privacy Act (CCPA) is a law of the State of California (USA) relating to the protection and processing of personal data of California residents. The CCPA came into force on January 1, 2020.

EPS (Earnings per share): Net income attributable to the Groupe divided by average number of shares, not diluted.

Free cash flow: Net cash flow from operating activities after financial income received, financial interest disbursed and repayment of lease commitments and related interest.

Free cash flow before changes in WCR: Net cash flow from operating activities after financial income received and financial interest disbursed, before repayment of lease commitments and related interest, and before change in working capital related to operating activities.

GDPR: The General Data Protection Regulation (GDPR) refers to Regulation (EU) 2016/679 of the European Parliament and of the Council of April 27, 2016 on the protection of natural persons with regard to the processing of personal data and on the free movement of such data.

GSM, OGM, CGSM: General Shareholders’ Meeting, Ordinary General Shareholders’ Meeting, Combined General Shareholders’ Meeting.

Headline EPS, diluted (Headline earnings per share, diluted): Headline Groupe net income, divided by average number of shares, diluted.

Headline net income, Groupe share: Net income attributable to the Groupe, after elimination of impairment charges/real estate transformation expenses, amortization of intangibles arising on acquisitions, the main capital gains (or losses) on disposals, change in the fair value of financial assets and the revaluation of earn-outs.

Net debt (or net financial debt): Sum of long- and short-term financial debt and associated hedging derivatives, less cash and cash equivalents.

Net revenue: Revenue less pass-through costs. Those costs are mainly production & media costs and out-of-pocket expenses. As these items that can be passed on to clients are not included in the scope of analysis of transactions, the net revenue indicator is the most appropriate for measuring the Groupe’s operational performance.

Operating margin: Revenue after personnel costs, other operating expenses (excl. non-current income and expenses) and depreciation (excl. amortization of intangibles arising on acquisitions).

Organic growth: Change in net revenue excluding the impact of acquisitions, disposals and currencies.

-

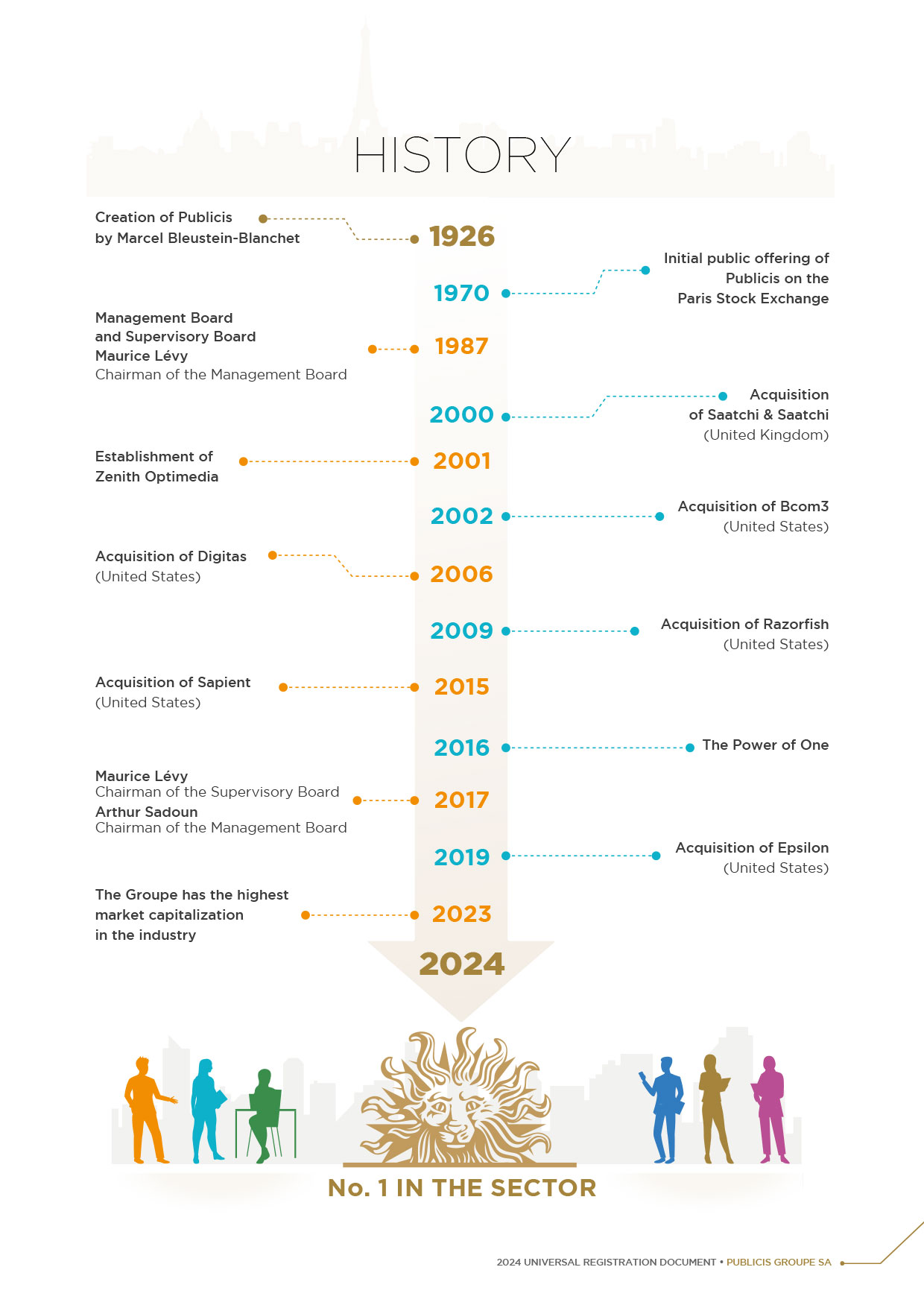

1.1 GROUPE HISTORY

In 1926 , Marcel Bleustein-Blanchet created an advertising agency called Publicis: “Publi,” for “Publicité,” which means “advertising” in French, and “six” for 1926. The founder’s ambition was to transform advertising into a true profession with social value, applying rigorous methodology and ethics, and to make Publicis a “pioneer of modern advertising.” The Company quickly won widespread recognition. In the early 1930s , Marcel Bleustein-Blanchet was the first to recognize the power of radio broadcasting, a new form of media at the time, to establish brands. Publicis became the exclusive representative for the sale of advertising time on the government-owned public broadcasting system in France. But in 1934 , the French government removed advertising on state radio; Marcel Bleustein-Blanchet decided to launch his own station, “Radio Cité,” the first private French radio station. In 1935 , he joined forces with Havas to form a company named “Cinéma et Publicité,” which was the first French company specialized in the sale of advertising time in movie theaters. Three years later, he launched “Régie Presse,” an independent subsidiary dedicated to the sale of advertising space in newspapers and magazines.

After suspending operations during the Second World War, Marcel Bleustein-Blanchet reopened Publicis in early 1946 , and not only renewed his relationships with pre-war clients but went on to win major new accounts: Colgate-Palmolive, Shell and Sopad-Nestlé. Recognizing the value of qualitative research, in 1948, he made Publicis the first French advertising agency to conclude an agreement with the survey specialist IFOP. Later, he created an in-house market research unit. At the end of 1957, Publicis relocated its offices to the former Hotel Astoria at the top of the Champs-Élysées. In 1958 , it opened the Drugstore on the first floor, which has since become a Paris landmark. In 1959 , Publicis set up its department of “Industrial Information,” a forerunner of modern corporate communications.

From 1960 to 1975 , Publicis grew rapidly, benefiting in particular from the beginnings of advertising on French television in 1968. The Boursin campaign inaugurated this new media: this was the first television-based market launch in France, and the slogan soon became familiar to everyone in the country: “Du pain, du vin, du Boursin” (“Bread, wine and Boursin”). Several months later, Publicis innovated again by siding with one of its clients in a new kind of battle: the defense of Saint-Gobain, for which BSN had launched the first-ever hostile takeover bid in France.

In June 1970, 44 years after its creation, Publicis became a listed company on the Paris Stock Exchange.

However, on September 27, 1972, Publicis’ head offices were entirely destroyed by fire. A new building was built on the same site and the Company set about pursuing a strategy of expansion in Europe through acquisitions the same year, taking over the Intermarco network in the Netherlands (1972), followed by the Farner network in Switzerland in 1973; this resulted in the creation of the Intermarco-Farner network to support the expansion of major French advertisers in other parts of Europe. In 1977, Maurice Lévy was appointed Chief Executive Officer of Publicis Conseil, the Groupe’s main French business, after joining Publicis in 1971.

In 1978 , Publicis set up operations in the United Kingdom after acquiring the McCormick advertising agency. In 1984, Publicis had operations in 23 countries across Europe. In 1981, Publicis opened a very small agency in New York.

In 1987 , Marcel Bleustein-Blanchet decided to reorganize Publicis as a company with Supervisory and Management Boards. He became Chairman of the Supervisory Board, and Maurice Lévy was appointed Chairman of the Management Board. Since then, the strategy for Publicis has been defined by the Management Board and submitted to the Supervisory Board for approval; all operational decisions are made at the Management Board level.

In 1988 , Publicis concluded a global alliance with the American firm Foote, Cone & Belding Communications (FCB) and the two European networks of the two partners merged. Publicis thus expanded its global presence with the help of its ally’s network.

Growth accelerated in the 1990s. France’s number four communications network, FCA!, was acquired by Publicis in 1993 , followed by the merger of FCA! with BMZ to form a second European network under the name FCA!/BMZ. In 1995 , Publicis terminated its alliance with FCB.

On April 11, 1996 , Publicis’ founder died. His daughter, Élisabeth Badinter, replaced him as Chairman of the Supervisory Board. Maurice Lévy stepped up the Company’s drive to build an international network and offer clients a presence in markets around the world. The drive to acquire intensified and became global: first Latin America and Canada, then Asia and the Pacific, India, the Middle East and Africa. The United States was the scene of large-scale projects from 1998 onwards, as Publicis looked to significantly expand its presence in the world’s largest market. Publicis acquired Hal Riney, then Evans Group, Frankel & Co. (relationship marketing), Fallon McElligott (advertising and new media), DeWitt Media (media buying).

In 2000 , Publicis acquired Saatchi & Saatchi, a business with a global reputation for talent and creativity. This acquisition was a milestone in the development of the Groupe in Europe and the United States. In September, Publicis Groupe was listed on the New York Stock Exchange.

In 2001 , Publicis Groupe formed ZenithOptimedia, a major international player in media buying and planning, by merging its Optimedia subsidiary with Zenith Media, which had previously been owned 50/50 by Saatchi & Saatchi and the Cordiant Group.

In March 2002 , Publicis Groupe announced its acquisition of the US Group Bcom3, which controlled Leo Burnett, D’Arcy Masius Benton & Bowles and Starcom MediaVest Group, and held a 49% interest in Bartle Bogle Hegarty. At the same time, Publicis Groupe established a strategic partnership with Dentsu, the leading communications Group in the Japanese market and a founding shareholder of Bcom3. The acquisition established Publicis Groupe in the top tier of the advertising and communications industry, making it the fourth largest advertising group worldwide, with operations in more than 100 countries and five continents.

From 2002 to 2006 , Publicis Groupe successfully integrated Bcom3, following Saatchi & Saatchi, and brought together a large number of entities. At the same time, it made a number of acquisitions to create a coherent range of services that would address clients’ needs and expectations, particularly offering different types of marketing services and access to the principal emerging markets.

The period between 2006-2013 marked the transformation of Publicis Groupe for the digital world. This was reflected by a profound change in its structure and operating methods to better adapt to the new demands of this new era. The Groupe added digital services to its well-known holistic offer while strengthening its position in fast-growing economies, both of which would be major strategic bets in the years to come. Amid fast growth in the digital arena, the most visible sign of the Groupe’s transformation was undoubtedly the launch of VivaKi, a new initiative aimed at optimizing the performance of advertiser investments. In January 2007 , Publicis Groupe completed the acquisition of Digitas Inc., the US leader and the world’s largest interactive and digital communications agency. The acquisition of Razorfish – the number two interactive agency in the world after Digitas – from Microsoft in October 2009 , brought new strengths to the Groupe’s digital activities, notably in e-commerce, interactive marketing, search engines, strategy and planning, social network marketing and the resolution of technological architecture and integration issues.

In 2009, Publicis Groupe became the world’s third-largest communications firm, overtaking its competitor Interpublic Group. This position has been considerably strengthened since then.

During 2012 and 2013 , the Groupe made a number of targeted acquisitions worldwide, particularly in the digital sector, in France, Germany, the United Kingdom, Sweden, the United States, Russia, Brazil, China, Singapore, India, Israel and, for the first time, in Palestine.

On July 27, 2013, Publicis Groupe and Omnicom Group Inc. signed an agreement for a merger of equals. In May 2014, Publicis Groupe chose not to pursue the merger with Omnicom Group Inc.

The most important transaction of 2014 was the acquisition of Sapient. In a world of growing convergence, the combination of Sapient with Publicis Groupe’s know-how created an unparalleled expertise in marketing and commerce across all distribution channels and consulting services based on outstanding technological prowess.

Publicis Sapient became part of the new organizational structure announced in 2015 , whose implementation was completed at the end of the first half of 2016 . This structure abandoned the holding company model in order to develop an operational architecture based on the Connecting Company concept. Highly modular in structure, Publicis Groupe’s Connecting Company model is unlike any other platform in the sector and offers clients plug & play access to its leading services:

- clients are the priority – Publicis Groupe’s entire transformation was designed and carried out in order to place clients at the heart of its operations;

- a fluid model – a single person, the Global Client Leader or Country Client Leader, acts as the sole point of contact and account manager who can draw on a pool of almost 84,000 people and break down silos, the legacies of the past and longstanding habits;

- working in harmony – consolidation of income statements and removal of all operational hurdles;

- modular organization – the main advantage of the structure is not just the depth and breadth of the Groupe’s capabilities, but above all the ability to adapt to any situation and to individual client requirements with an open architecture that offers global partners plug & play access where required;

- a unified offering – by bringing together the Groupe’s creativity, intelligence and technological expertise, it advises clients on how to carry out their own transformation, with ideas that are unlike any others in the sector.

Thus, Publicis connects all its expertise in an integrated way thanks to the “Power of One” to provide winning solutions to its clients.

In 2016 , on its 90th anniversary, Publicis Groupe launched a project named Publicis90. This idea was to provide 90 projects or start-ups with financial aid and the support of the Groupe’s digital experts. These projects were selected from 3,500 applications submitted from 130 countries.

At the beginning of 2017 , the Publicis Groupe Supervisory Board appointed Arthur Sadoun as Maurice Lévy’s successor as Chairman of the Management Board. Maurice Lévy became Chairman of the Supervisory Board.

2017 was marked by two themes: pursuing integration and accelerating in the execution of the strategy initiated by Maurice Lévy. The Groupe had the ambition of becoming the leader in the convergence of marketing and operational transformations, through the alchemy of creativity and technology.

After breaking the silos and organizing itself into Solutions, the Groupe went a step further by implementing an organizational structure by country, with the aim of providing clients with a fully integrated offer, from advertising to marketing, consulting, and media, with data at its core. The deployment of this organization began in France, the United Kingdom, China and Italy.

Publicis Groupe looked to equip itself with a system that would serve its talent. The Marcel artificial intelligence platform, developed in partnership with Microsoft, and named in tribute to the Groupe’s founder, Marcel Bleustein-Blanchet, was launched in May 2018 . The aim of Marcel is to facilitate the transformation from a holding company to a platform so that all Groupe employees worldwide can discuss and collaborate without barriers or borders.

2019 was a pivotal year for the Groupe with the acquisition of Epsilon. Epsilon has the technology and platforms to structure client first-party data, round it out with an incomparably diverse range of data sources and put together personalized campaigns at scale. The Groupe’s activities were resolutely positioned to the future, with more than 30% of net revenue generated by data and digital business transformation.

At the same time, the Power of One strategy, initiated in 2016, became fully effective. Through the Groupe Client Leader, clients are offered a tailored service and direct access to the Groupe’s entire range of expertise. The Groupe helps its clients to constantly innovate and grow their sales, while controlling costs.

In 2019, the Groupe completed its transformation in terms of assets and structure. The Groupe was in a unique position to serve clients across the entire value chain. It is the only one to have large-scale assets in creativity, media, data and technology.

2020 was marked by the global Covid-19 pandemic, which affected all countries and sectors of activity for most of the year. This major health crisis resulted in one of the largest economic crises in recent history.

In such a challenging environment, the Groupe managed to deliver solid results thanks to the transformation undertaken several years earlier: the Groupe’s investment in data and technology, with the acquisitions of Sapient and then Epsilon; its country organization, which enabled it to closely support its clients at every stage of the crisis and to provide a comprehensive and integrated offer combining data, technology, media and creativity; its Marcel platform, which allowed the Groupe to adapt to new ways of working with better knowledge sharing, even from a distance. Marcel brought teams together and proved to be a valuable tool during such a period.

2021 was exceptional in more than one aspect. Firstly, it saw a strong rebound in advertising spend globally, boosted by general economic growth and multiple stimuli from central banks and governments. It was also marked by the continuation of structural changes in the industry, in first-party data management, new digital media, the evolution of commerce and digital business transformation. In this environment, the Groupe achieved record results with all indicators exceeding their 2019 levels. Furthermore, the Groupe acquired CitrusAd, a technology platform that optimizes the marketing performance of brands directly on e-commerce sites.

The Groupe emerged from the pandemic both stronger and even more committed to ESG, as reflected by the Groupe taking first place in the sector in the rankings of eight of the top ten rating agencies.

In 2022 , the Groupe’s revenue exceeded euro 14 billion for the first time and net revenue euro 12 billion, driven in particular by double-digit organic growth for the second consecutive year. The Groupe made several acquisitions in the fields of data (Retargetly in Latin America), commerce (Profitero) and digital transformation (Tremend). In addition, the Groupe announced the creation of Unlimitail, a joint venture with Carrefour, to respond to the booming retail media market in Continental Europe and Latin America.

On the ESG front, the Groupe laid the foundations for a major initiative, # WorkingWithCancer, aimed at eradicating the stigma of cancer in the workplace by supporting affected employees or those whose relatives are affected by the disease. Many companies have joined the project since the beginning of 2023.

With revenue of nearly euro 15 billion in 2023 , Publicis reinforced its position as the second-largest player in the industry and the leading player in terms of market capitalization. During the year, the Groupe made several acquisitions: Yieldify in the field of technological marketing; Practia, a leader in digital transformation in Latin America; and Corra, a leader in e-commerce recognized by Adobe as the one of the best companies in North America.

2024 will remain a historic year for Publicis Groupe. With net revenue of nearly euro 14 billion, the Groupe became the world’s leading advertising group. This performance is the result of efforts made over many years, generating market share gains, the contribution of numerous investments in data and technology, and the benefit of its platform organization, placing the Groupe at the heart of its organization. In 2024, the Groupe set up a new organizational structure around three pillars: Connected Media, bringing together data, media, CRM, social and commerce activities; Intelligent Creativity, including creative, production and public relations; and Technology with Publicis Sapient. The challenge is to meet clients’ key needs, to make marketing a measurable business tool and ensure the sustainability of their business model. In addition, Publicis Groupe made two significant acquisitions: Influential in influencing marketing and Mars United in commerce.

-

1.3 ACTIVITIES AND STRATEGY

1.3.1 Introduction

Publicis is a world leader in marketing, communications and digital business transformation, established in 1926 when Marcel Bleustein-Blanchet created what was essentially a start-up.

The passion that Marcel felt for communications and the creation of strong relations between brand names and consumers transformed this new business into a prosperous and respected profession. The Groupe has never stood still, continuing to grow, innovate and transform for nearly 100 years. The core values dear to its founder’s heart have continued to define everything we do: respect, honest products, client satisfaction, quality and creativity, together with a pioneering spirit, unwavering conviction and the ethical values inherited from his legendary fighting spirit.

-

1.4 INVESTMENTS

Our investments focus on digital expertise, data and technology to strengthen our teams and promote innovation and the offer of new services. The strengthening of our agencies and the development of strategic partnerships and initiatives with major Internet players enables Publicis Groupe to anticipate the changes and evolution of communication industries towards digital technologies. The aim is to offer the most innovative solutions to our clients, in step with the rapid changes in consumer behavior and technologies.

1.4.1 Main investments and divestments during the past three years

In 2022 , the Groupe made several acquisitions to strengthen its capabilities in Data, Digital Business Transformation and Commerce. In digital transformation, the Groupe acquired Tremend , a Company of 650 engineers and developers, founded 16 years ago and based in Bucharest (Romania), to develop the new Publicis Sapient global distribution center in Europe. The Groupe also acquired Tquila ANZ , one of the leading multi-cloud solution consulting firms in Australia, with the aim of strengthening the Salesforce expertise of Publicis Sapient. In Commerce, the Groupe acquired the SaaS platform Profitero . With 300 employees, this world leader in e-commerce intelligence enables brands to analyze and optimize their sales, marketing and operational performance on 70 million products sold online on more than 700 e - commerce sites worldwide. In Data, the Groupe acquired Retargetly and Yieldify and integrated them within Epsilon. Retargetly works with distributors and publishers to combine first-party data with partner data for personalized targeting and audience measurement on digital channels. This acquisition enabled Epsilon to launch its activities in Latin America. In addition, the acquisition of Yieldify strengthened the Epsilon offering with solutions that improve the personalization of sites and the optimization of conversions and the client experience.

Following the conflict between Ukraine and Russia, Publicis announced in March 2022 its withdrawal from Russia , with the transfer of control of its agencies to local management. The Groupe transferred control of its operations to Sergey Koptev, founding Chairman of Publicis in Russia, with a contractual commitment to ensure a future for its 1,200 employees in the country. Publicis stopped its business and investments in Russia, and the cession was effective immediately. This disposal, effective immediately, led to an exceptional loss on disposal of euro 87 million. Russia has been deconsolidated since April 1, 2022.

Total acquisition costs for entities integrated during 2022 (gross payments, after excluding cash and cash equivalents acquired) came to euro 523 million, including euro 119 million in earn-out payments. In addition, euro 49 million was paid out as part of the disposal of Russia (cash of divested entities).

In 2023 , Publicis announced the acquisition of Practia , one of the leaders in digital transformation services in Latin America, based in Argentina. With its 1,200 experienced professionals, this acquisition will position Publicis Sapient to enter the Latin American market while establishing a foundation for a nearshore delivery platform that will enable the Company to better service clients based in North America. Also, in digital transformation, the Groupe acquired Corra , based in New York, a leader in e-commerce who will augment Publicis Sapient’s existing expertise in commerce solutions, including Adobe Commerce, while extending Publicis Sapient’s offerings in digital and omnichannel commerce.

In order to address the booming demand for retail media in Continental Europe, Brazil and Argentina, Publicis and Carrefour announced the launch of their joint venture Unlimitail , based on the most advanced technologies from “CitrusAd powered by Epsilon” and the deepest retail expertise in the mass market retail sector from Carrefour.

Finally, with Publicis Sapient AI Labs and PS Hummingbird, the Groupe has invested in specialized joint ventures in Artificial Intelligence (AI) to strengthen this expertise at Publicis Sapient.

With Influential , Publicis Groupe invested in the world’s preeminent influencer marketing company and platform. Influential’s proprietary AI-powered technology platform with over 100 billion data points, coupled with its network of over 3.5 million creators, including access to and data on 90% of global influencers with more than 1 million followers, currently serves more than 300 brands around the world. By combining these capabilities with the unique data and identity assets of Epsilon, Publicis Groupe is putting the leadership of ID-driven influencer marketing in the hands of all of its clients through a premium creator network, revolutionized influencer planning and maximized cross-channel outcomes.

The Groupe significantly strengthened its commerce offer through the acquisition of Mars United Commerce , the largest independent commerce marketing company in the world. With over 1,000 employees based in 14 hubs worldwide, Mars leverages its proprietary suite of commerce solutions to drive growth for more than 100 of the world’s top brands. The combined forces of Publicis Groupe and Mars has created the industry-leading connected commerce solution, allowing clients to influence the complete commerce journey for billions of global shoppers through an offering that begins with the industry’s deepest and richest database of consumer behavior and ends at the digital and physical shelves of the world’s leading online and offline retailers.

The Groupe also acquired AKA Asia , one of Singapore’s leading integrated communications agencies. The acquisition expands and diversifies Publicis Groupe’s capabilities in the market while bolstering the Groupe’s strategic communications, PR and influence offering. AKA joins the Groupe’s regional Influence division.

In France, Publicis Groupe acquired Downtown Paris , a “creative and production house specializing in the world of luxury goods and beauty, intended to strengthen the production activity of Publicis France and to work with the Groupe’s various luxury goods entities.

-

1.5 MAJOR CONTRACTS

-

1.6 RESEARCH AND DEVELOPMENT

The Groupe does not believe that it is dependent on any specific patent or license to operate its businesses.

R&D within Publicis Groupe has always taken an applied form, as it is directly linked to the search for concrete technological solutions designed to help our clients, to developing and improving the performance of our products, technological platforms or internal tools, and to taking advantage of the latest technological advances to offer new options to our clients. Several PhD students work within the Groupe, most of them at Sapient and Epsilon.

At Epsilon, more than 70 PhD students in decision science are continuously optimizing the algorithms of our platforms to make them more precise, more powerful, and ultimately, more effective. A specific program hosts 15 PhD students for one year to monitor the work of the Decision Science teams. Every year, Epsilon organizes an internal hackathon and an internal Tech conference, intended to mobilize all their engineers in a short time to work on very specific technical topics - in recent years around the integration of AI in PeopleCloud. The solutions resulting from these sessions are tested, verified and then deployed to be rapidly operational for clients.

Publicis Sapient has developed seven “Labs” in North America, Europe, India and Latin America, which are centers of technical expertise to respond in real time to clients’ technological issues. Our experts are available to answer client questions regarding the implementation of different platforms and the search for optimal solutions, and these teams can conduct Research & Development projects on behalf of clients to improve the performance of their tools or develop a new application environment (interconnection architecture, website, app, internal network). Two approaches enable the Groupe’s internal engineering community to work more effectively together. On the one hand, thanks to an internal collaboration platform several teams of engineers can cooperate simultaneously on the same project. On the other hand, it is an agnostic solution for the cloud, artificial intelligence/machine learning projects bring together engineers and data scientists in order to gain efficiency and speed for large-scale solutions for clients. With the influence of AI and Generative AI, Publicis Sapient’s expertise in this area is an asset in terms of innovation for clients, on how to use these new tools to improve products, services and user experiences. The skills spectrum of these teams covers Data Science, Data Strategy, Data Engineering and Data Analytics, which are partners in AI Accelerators and AI Labs, thus enabling rapid experimentation with new solutions. These teams also include computer science, artificial intelligence, machine learning, mathematics, physics and engineering specialists.

Lastly, the Groupe’s Media activities invest significant resources in mathematical and statistical processing in order to best advise their clients in their media choices (particularly in terms of modelling the marketing mix or calculating the effectiveness of media actions), and many doctoral students are also part of these teams.

-

2.1 MAIN RISK FACTORS

The risk factors described below, together with the other information concerning Publicis Groupe and its consolidated financial statements included in this Universal Registration Document should be carefully considered before making an investment in the shares or other securities of Publicis Groupe. This section covers the main risks to which Publicis Groupe feels exposed to, as of the date of this Universal Registration Document. Each one of the risk factors may have a negative impact on the Groupe’s earnings and financial position as well as on its share price or financial instruments. Other risks and uncertainties of which Publicis is unaware of or which are not currently considered to be significant could also have a negative impact on the Groupe.

Description of the main risk factors

In accordance with the provisions of article 16 of Regulation (EU) 2017/1129, in each of the risk categories mentioned below, risks are presented in descending order of significance according to the Groupe’s assessment at the date of this document. The risk factors considered the most significant are presented first, following an assessment of their potential impact and likelihood after taking into account the mitigating measures implemented. The significance of the risks, as assessed by Publicis Groupe, may be amended at any time in light of changes in the Groupe’s activities and circumstances.

At the filing date of this Universal Registration Document, the geopolitical environment remains marked by the continued conflict in the Middle East and between Russia and Ukraine. The Groupe’s direct exposure to these conflict countries is low (less than 0.4% of revenue).

The United States has initiated many changes, in particular through Executive Orders. These cover various aspects of economic life and may impact the Groupe’s operations, its clients and partners in the United States and other countries. As of the date of this Universal Registration Document, the Groupe, like all economic players, is unable to assess their impact on its activities.

-

2.2 INTERNAL CONTROL AND RISK MANAGEMENT PROCEDURES

2.2.1 Objectives and organization (1)

The internal control and risk management framework is fully integrated into the Groupe’s operational, financial and non-financial management. Its remit extends across all the Groupe’s activities and structures. The internal control and risk management policy defined by the Executive Management, is regularly monitored by the Audit and Financial Risks Committee together with the Strategic, Environmental and Social Committee, and relayed to all levels of the Groupe. This policy aims to provide reasonable assurance on the achievement of the Groupe’s objectives in terms of:

- reliability of financial and non-financial information;

- compliance with applicable laws and regulations;

- management of strategic, operational? financial and non-financial risks;

- efficacy and efficiency of operations, in line with the direction set by the Executive Management.

The objectives of this framework, as approved by the Executive Management and presented to both the Audit and Financial Risks Committee and the Strategic, Environmental and Social Committee, are to enable:

- continuous monitoring aimed at identifying risks and opportunities having a potential impact on the achievement of the Groupe’s strategic, operational, financial and non-financial objectives;

- appropriate communication about risks contributing to the decision-making process;

- regular monitoring of the internal control and risk management framework effectiveness.

The Groupe has a Secretary General function, which allows organized and centralized monitoring of the activities that constitute the internal control framework. The Secretary General is a member of the Groupe’s Management Committee. This function includes the Legal Department (managed by the Groupe General Counsel), the Compliance Department (managed by the Groupe Chief Compliance Officer) , the Internal Audit, Internal Control and Risk Management Department (managed by the Groupe Internal Audit, Investigation & Risk Management Officer), the Human Resources Department (compensation and employee benefits, human resources information system management, employee-related matters and mobility) and the Insurance Department. The Chairman and Chief Executive Officer and the Secretary General participate in all meetings of the Strategic, Environmental and Social Committee. The Secretary General and the Groupe Internal Audit, Investigation and Risk Management Officer attend all Audit and Financial Risks Committee meetings and have easy access to its Chair and each of its members. Similarly, the Audit and Financial Risks Committee has direct access to the Groupe’s Risk Management and Internal Control department.

Since May 2024, the Chief Impact Officer has been overseeing Corporate Social Responsibility (CSR), including the CSR strategy, sustainability reporting, and key initiatives of the Groupe. The CSR Department is responsible for non-financial reporting and collaborates closely with other departments within the Groupe, particularly through the CSR Steering Committee. Additionally, the Chief Impact Officer regularly updates the Audit and Financial Risks Committee and the Strategic, Environmental, and Social Committee on regulatory changes in sustainability reporting, the status of ongoing projects, and the work being conducted with external sustainability auditors.

The expertise of the Secretary General and the CSR Department offers a comprehensive understanding of risks, which enhances the organization’s goal of improved risk management through the implementation of an internal control system.

Furthermore, the Board of Directors, via the Audit and Financial Risks Committee, reviews the effectiveness of the Groupe’s internal control and risk management framework and oversees the preparation of both financial and non-financial information.

The Groupe’s internal control and risk management system bases its structure on the 2013 COSO (Committee of Sponsoring Organizations of the Treadway Commission) guidelines, as well as the reference framework established by the AMF.

- first line: first line consists of operational managers within the entities, business units, shared services, and various countries and regions. These managers are responsible for managing risks as part of their daily operations. They act in accordance with relevant laws and regulations, ensuring adherence to the rules and guidelines established in Janus;

- second line: the second line functions are performed by the head office departments, which establish the policies, standards and procedures. These functions define and deploy the risk management framework and ensure compliance with laws and regulations, design controls to ensure compliance with Janus, monitor the adequacy and effectiveness of the internal control system, and facilitating the prompt remediation of any identified weaknesses;

- third line: the third line is provided by the internal audit function, which provides independent assurance on the effectiveness of governance, risk management and internal control.

-

2.3 INSURANCE AND RISK COVERAGE

The insurance policy’s purpose, centrally managed within the Insurance Department, is to provide the best coverage for the Groupe’s people and assets by achieving the right balance between local and corporate insurance coverage.

By implementing two-tier insurance coverage (local and centralized), the Groupe strives to ensure complementarity of guarantees and thus better risk management across all the countries in which Publicis is present.

On a local level, mainly through the Re:Sources shared service centers, entities must purchase general liability, property damage and business interruption, automobile and employer’s liability insurance policies, as well as health and life insurance coverage for local employees. This insurance is taken out in compliance with the local regulations.

The only exception is the European zone: using the free provision of services framework in Europe, the Groupe has taken out a property damage and business interruption insurance policy and a general liability insurance policy which is available to all European subsidiaries.

At Groupe level, insurance programs have been implemented with leading insurance companies with the aim of automatically covering all subsidiaries against the financial consequences of risks such as, but not limited to:

- professional liability and cyber risks;

- director and officer liability;

- civil liability related to employment practices;

- general liability when terms and conditions or limits differ from the local insurance policies;

- property damage and business interruption when terms and conditions or limits differ from the local insurance policies;

- assistance and repatriation of employees during business travel.

In addition, the Groupe negotiates and sets up specific coverage that subsidiaries may subscribe to depending on their business needs, such as credit insurance, health and life insurance for expatriates and specific insurances for film and TV shoots.

The insurance policies are regularly reviewed to customize the coverage to any changes in our activity and, in particular, new digital services: the Groupe focuses particularly on this risk and its cyber-risk insurance coverage.

The amount of coverage is considered to be consistent with identified risk levels and with market practices.

In light of the Groupe’s significant mergers and acquisitions activity, the Insurance Department also oversees the integration of acquired entities within the Groupe’s program.

In June 2022, the Groupe set up Publicis Ré SA, a captive reinsurance Company within the meaning of article L. 310-1-1 of the French Insurance Code. Publicis Ré is a wholly-owned French subsidiary dedicated to the reinsurance of the Groupe’s risks. It was approved on October 10, 2022 by the French Prudential Supervision and Resolution Authority (ACPR) to operate as a non-life reinsurer.

-

3. CORPORATE GOVERNANCE

The information contained in the following developments is that mentioned in articles L. 225-37-4 and L. 22-10-8 to L. 22-10-10 of the French Commercial Code. Other information in the report, notably that mentioned in article L. 22-10-11 of the French Commercial Code, is listed in Section 3.1.7 as well as Section 10.9 of the Universal Registration Document “Cross-reference table for the corporate governance report.”

This report also includes information required for the preparation of the sustainability report according to the European sustainability reporting standards. It will be identified using footnotes and presented in the cross-reference table available in Section 4.8.

Publicis Groupe SA refers to the corporate governance code for listed companies established by the AFEP and MEDEF (hereinafter the “Afep-Medef Code”) as updated in December 2022. This Code can be consulted online on the AFEP website www.afep.com, the MEDEF website www.medef.com, and the French High Committee on Corporate Governance ( Haut Comité de Gouvernement d’Entreprise - HCGE ) website www.hcge.fr.

-

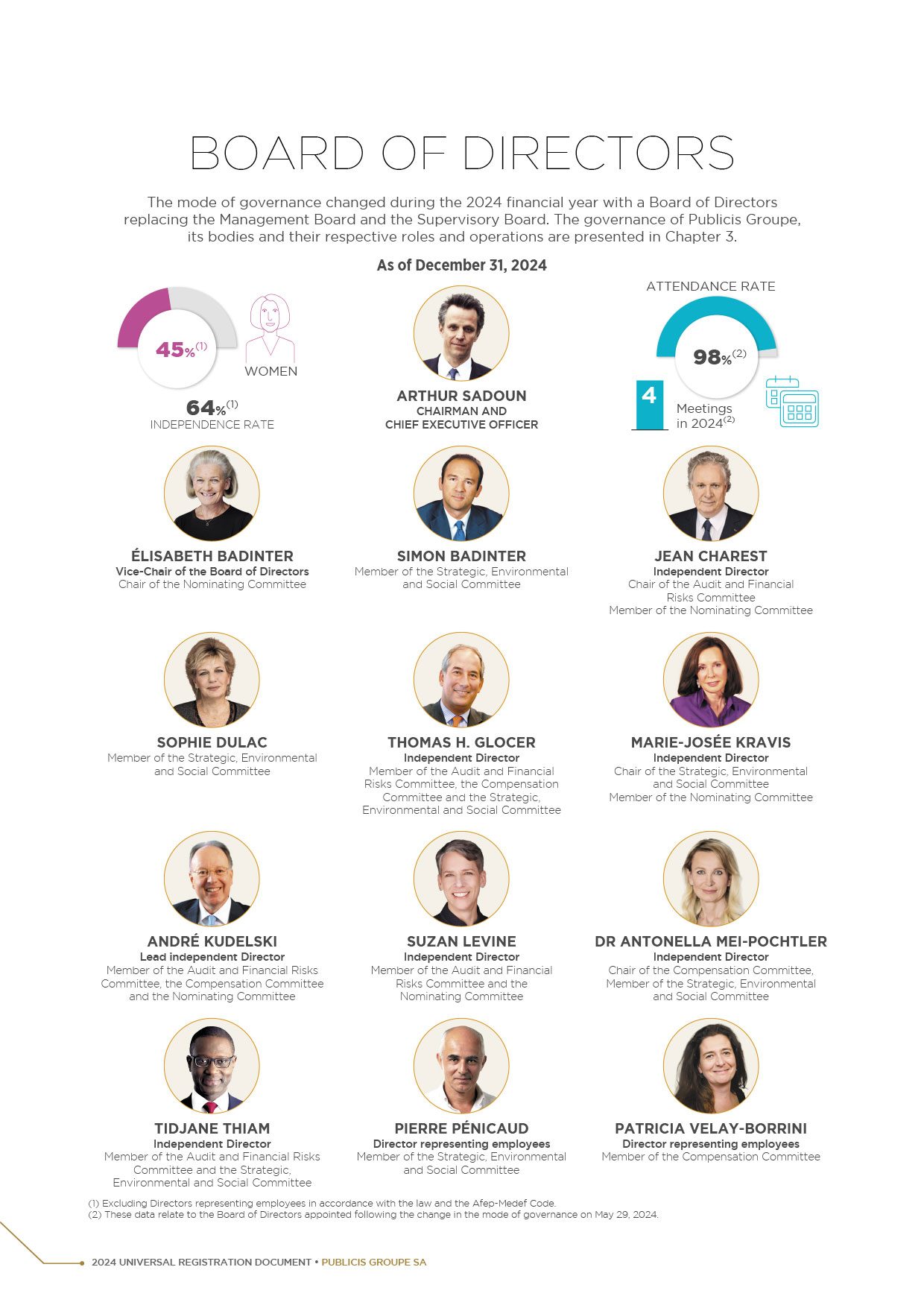

3.1 GOVERNANCE OF PUBLICIS GROUPE (1)

The General Shareholders’ Meeting of May 29, 2024 approved (with a rate of 94.93%) the change in the mode of governance of Publicis Groupe SA by adopting a structure with a Board of Directors instead of a structure with a Supervisory Board and Management Board. The General Shareholders’ Meeting also approved the new composition of the Board of Directors (for more information on the composition of the Board of Directors, see Section 3.1.2).

This change is the result of a long and rigorous process initiated by Mr. Maurice Lévy in the interest of the company, all stakeholders, and in particular shareholders. This change makes it possible to reconcile three major requirements: first, a controlled transition; then, continuity; and finally, effective and balanced governance.

In this context, Mr. Arthur Sadoun, former Chairman of the Management Board, was appointed as Chairman and Chief Executive Officer and Mr. Maurice Lévy, former Chairman of the Supervisory Board, was appointed as Emeritus Chairman, thus preserving the tandem formed by Mr. Arthur Sadoun and Mr. Maurice Lévy since 2017, key ingredients of the Groupe’s success.

This change was accompanied by appropriate measures to ensure balanced governance. This is ensured by the continuity of the position of Vice-Chair of Mrs. Élisabeth Badinter, by the strengthened organization of the Board Committees to enable them to monitor the Company’s risks and strategy more closely, and by the creation of a position of Lead Director, held by Mr. André Kudelski.

For the sake of simplicity and transparency, note that Mr. Arthur Sadoun, Mr. Loris Nold (as of February 8, 2024, replacing Mr. Michel-Alain Proch) and Mrs. Anne-Gabrielle Heilbronner served as members of the Management Board until May 29, 2024. During the financial year 2024, the Management Board carried out all of its duties within the framework set by the Articles of Incorporation and the internal rules and regulations of the Supervisory Board. It met six times with an attendance rate of 100%. The Management Board’s work focused on: the consolidated and corporate financial statements for the financial year 2023, the provisional management documents for the year ended December 31, 2023, the Groupe’s financial and cash position, the 2024 budget, the Groupe’s financial communication, monitoring of share plans, the implementation of a share buyback program and acquisitions and monitoring of the Groupe’s CSR strategy. The Management Board regularly reported to the Supervisory Board on its duties and the Groupe’s activities.

3.1.1 Governance structure (1)

Pursuant to French regulations and the Afep-Medef Code, the Board of Directors has the authority to choose between the two methods of exercising Executive Management, namely the separation or combination of the roles of Chairman of the Board of Directors and Chief Executive Officer of the Company.

On the recommendation of the Nominating Committee, the Board of Directors decided on May 29, 2024 to combine the roles of Chairman of the Board of Directors and Chief Executive Officer, and to appoint Mr. Arthur Sadoun as Chairman and Chief Executive Officer for the entire duration of his term of office as Director, i.e. until the end of the 2028 General Shareholders’ Meeting called to approve the financial statements for fiscal year ended December 31, 2027.

Combining the functions of Chairman and Chief Executive Officer is the most appropriate organizational method for Publicis Groupe’s current situation, its agility, its business sector, its geographical locations and the challenges it faces. The Board considered that unifying the roles of Chairman and Chief Executive Officer would make it possible to further improve the effectiveness of the management team, thanks to a responsive and agile governance system in its decision-making under the impetus and control of the Board of Directors, while ensuring continuity in the governance of the Groupe, which has been at the heart of Publicis’ success since its creation.

This is all the more important given that, in the Groupe’s business sector, like no other, talent is at the heart of success. A strong feature of this industry is that only a manager from the core business is legitimate and capable of taking on the leading role and succeeding in it. In addition, the success of any company is based on a long-term strategy served by long-term management teams. Publicis has only had three executives in its nearly 100 years of existence: the founder, Mr. Marcel Bleustein-Blanchet for 60 years, Mr. Maurice Lévy for 30 years and Mr. Arthur Sadoun since 2017. This continuity of leadership is a major asset that must be preserved so as not to destabilize the balance of teams and customer relations.

In accordance with the internal rules and regulations of the Board of Directors, the Nominating Committee may reassess the relevance of the choice of governance method, in particular when renewing the term of office of the Chairman and Chief Executive Officer. The Nominating Committee endeavors to formulate its proposals with a view to building a solid, sustainable and fluid governance for the Groupe, taking into consideration all measures to ensure the balance of powers within the new Board of Directors.

Since May 29, 2024, Mr. Arthur Sadoun has been Chairman and Chief Executive Officer of Publicis Groupe SA (for more information on the profile of Mr. Arthur Sadoun, see Section 3.1.2.3).

Given the choice to unify the functions of Chairman of the Board of Directors and Chief Executive Officer, the Chairman and Chief Executive Officer performs the duties assigned to the Chairman of the Board and assumes the Executive Management of the Company. In this respect, the provisions of the Articles of Incorporation applicable to the Chairman of the Board are also applicable to the Chief Executive Officer.

The Chairman and Chief Executive Officer has all the powers conferred by the law, the Company’s Articles of Incorporation and the internal rules and regulations of the Board of Directors.

Extract from article 11 of the Articles of Incorporation:

The Chairman shall perform the duties and exercise the powers vested in him/her by law and by the Articles of Incorporation.

He/She chairs the meetings of the Board of Directors and organises and directs its work and meetings, on which the Chairman reports to the General Shareholders’ Meeting. The Chairman shall ensure the smooth functioning of the Company’s governing bodies and, in particular, the ability of the Directors to perform their duties. The Chairman chairs the General Shareholders’ Meetings and prepares the reports required by law.

[…]

The age limit for holding the office of Chairman of the Board of Directors is seventy-five years.

In addition, as Director, the Chairman and Chief Executive Officer is fully subject to the rules intended to prevent the occurrence of conflicts of interest pursuant to the law as well as by the internal rules and regulations (the rules pursuant to the latter are described at Section 3.1.1.6).

Extract from article 16 of the Articles of Incorporation:

[…]

The age limit for appointment as Chief Executive Officer is seventy years.

[…]

The Chief Executive Officer is vested with the broadest powers to act on behalf of the Company in all circumstances. He/She shall exercise his/her powers within the scope of the Company’s corporate purpose and subject to the powers expressly conferred by law to the General Shareholders’ Meeting and the Board of Directors. He/She represents the Company in its relations with third parties. The Chief Executive Officer may grant, with or without the option of substitution, any delegations to any corporate officers that he/she designates, subject to the limitations pursuant to the law.

[…]

When the Chairman of the Board of Directors assumes responsibility for the executive management of the Company, the provisions of the Articles of Incorporation and the law shall apply with respect to the Chief Executive Officer. He/She shall assume the title of Chairman and Chief Executive Officer and may remain in office until the Ordinary General Shareholders’ Meeting convened to approve the financial statements for the previous year and held in the year in which the Chief Executive Officer reaches the age of seventy.

In accordance with the Board’s decisions made at its meetings of May 29 and July 17, 2024 and its internal rules, the Chairman and Chief Executive Officer must obtain the prior authorization of the Board of Directors to carry out the following transactions:

- any investment and divestment operation envisaged by the Groupe, in particular the acquisition and disposal of assets (including the acquisition and disposal of all or part of equity interests), the subscription to any securities issues, the conclusion of partnerships or the pooling of resources with a unit value in excess of euro 300 million (including earnout);

- any real estate acquisition or disposal transaction contemplated by the Company;

- any financing operation envisaged by the Groupe, regardless of the terms and conditions, involving a unit amount in excess of 5% of the Company’s shareholders’ equity;

- all mergers, demergers and asset contributions envisaged by the Groupe for net asset contribution values individually exceeding 5% of the Company’s shareholders’ equity, excluding any internal restructuring;

- all transactions and compromises relating to litigation contemplated by the Groupe involving unit amounts in excess of 5% of the Company’s shareholders’ equity;

- any significant transaction planned by the Groupe that falls outside the scope of the strategy announced by the Company or is likely to have a material impact on it.

In addition, the Chairman and Chief Executive Officer must obtain annual authorization from the Board of Directors, up to the limit set by the Board, to issue sureties, endorsements or guarantees given on behalf of the Company.

Since May 29, 2024, the Vice-Chair of the Board of Directors has been Mrs. Élisabeth Badinter, a long-standing and significant shareholder of Publicis Groupe SA.

In the absence of the Chairman of the Board of Directors, the Vice-Chair convenes the Board and chairs its discussions.

Mrs. Élisabeth Badinter contributes to ensuring balanced governance within the Groupe. Through her long experience and her essential contribution to all the work of the Board, Mrs. Élisabeth Badinter always ensures that the Groupe’s fundamental values are respected in the interest of its leading stakeholders, including the employees and shareholders.

In 2024 in particular, the Vice-Chair convened and chaired the discussions of the Board of Directors of May 29, 2024, prior to the appointment of the Chairman and Chief Executive Officer (for more information on the profile of Mrs. Élisabeth Badinter, see Section 3.1.2.3).

The Board of Directors decided to create the status of Lead Director, a key function in the context of balanced governance.

In this context, the Board of Directors of May 29, 2024, on the recommendation of the Nominating Committee, appointed Mr. André Kudelski as Lead Director. His personality and experience will enable him to effectively carry out this role. This appointment is subject to maintaining the status of Independent Director for the duration of his term of office, it being specified that the Nominating Committee may reassess his situation as necessary. The Lead Director does not take part in the deliberations or votes of the Board and its Committees that concern him.

Mr. André Kudelski, previously a member of the Supervisory Board, was appointed by the General Shareholders’ Meeting of May 29, 2024 as a Director for a term of four years. As of December 31, 2024, he is a member of the Audit and Financial Risks Committee, the Nominating Committee and the Compensation Committee (for more information on the profile of Mr. André Kudelski, see Section 3.1.2.3).

The Lead Director’s main missions are to contribute to the balance of governance, to improve the organization of dialogue with and within the Board of Directors (in particular through the organization of executive sessions) and to be able to deal with potential conflicts of interest.

- have access to all the documents and information he deems necessary to fulfil his missions,;

- carry out or commission any external studies;

- meet the main operational managers of the Publicis Groupe;

- add items to the agenda of Board of Directors meetings;

- request the assistance of the Board Secretary.

The Lead Director meets regularly with the Chairman and Chief Executive Officer, the Vice-Chair of the Board of Directors and, if necessary, with the Emeritus Chairman.

Extract from article 3 II of the internal rules and regulations of the Board of Directors:

The main role of the Lead Director is to assist the Chairman in ensuring the proper functioning of the Company’s corporate governance bodies.

In this capacity, it may be consulted by the Chairman on proposed changes to the composition of the Company’s governance bodies, and on the selection process for independent Directors.

It is informed by the Chairman of questions raised by shareholders on social, environmental and governance issues, and ensures that they are answered.

He coordinates the work of the Independent Directors and acts as a liaison between them and Executive Management.

The Lead Director examines situations of conflict of interest and brings to the attention of the Board of Directors any conflicts of interest concerning Directors or the Chairman of the Board of Directors. The Lead Director may chair Executive Sessions.

The performance and compensation of the Chairman and the Executive Management are reviewed once a year at a Board of Directors’ meeting. Exceptionally, the Lead Director chairs the discussions relating to the review of the performance and compensation of the Chairman and Executive Management at this meeting.

The Lead Director may supervise the Board of Directors’ evaluation process, as described in article 6 of these internal rules and regulations.

The Lead Director reports to the Board of Directors once a year on the performance of his duties .

Main work completed in 2024 Relations with Executive Management The Lead Director regularly discussed the organization of governance with Executive Management.

He organized and led a meeting with the members of the Executive Committee to reflect on the Groupe’s strategy and future and to hold informal discussions.

Preparation of Board meetings The Lead Director was consulted in advance on the agendas of each Board of Directors’ meeting.

He attended all meetings of the Board and the Committees of which he is a member.

Assessment of the Board and Committees He supervised the assessment process of the Board and its Committees for the financial year 2024. In this context, he reviewed the draft questionnaire to be submitted to the Directors. He conducted individual interviews with Directors who so wished. He reported on these elements to the Board of Directors. Prevention of conflicts of interest In 2024, the Lead Director did not have to deal with any conflicts of interest within the Board of Directors. Executive sessions He organized and led a meeting between Independent Directors. The main conclusions of this meeting were brought to the attention of the Board of Directors at its meeting of November 27, 2024. Discussions with shareholders He was informed of the conclusions of the meetings organized with certain institutional investors and contributed to the shareholder dialogue on governance-related topics. Pursuant to the option provided for by the Company’s Articles of Incorporation and its internal rules and regulations, the Board of Directors may appoint an Emeritus Chairman who is a natural person and former Chairman of the Board of Directors or of the Supervisory Board.

On May 29, 2024, the Board of Directors, on the advice of the Nominating Committee, decided to appoint Mr. Maurice Lévy, former Chairman of the Supervisory Board, as Emeritus Chairman for an indefinite period, enabling the Company to continue to benefit from his talent, energy and experience.

Mr. Maurice Lévy joined Publicis Groupe in 1971 as IT Director. In 1975, he was appointed Executive Vice-President of Publicis Conseil, the Groupe’s flagship, working his way up to his appointment as Chairman of the Management Board in 1987. He held this role for 30 years, until the General Shareholders’ Meeting of May 2017, when he was appointed as Chairman of the Supervisory Board of Publicis Groupe SA. He steered the accelerated globalization of the Groupe starting in 1996. In 2001, Publicis Groupe’s globalization picked up more steam with the acquisition of Saatchi & Saatchi, then Bcom3 (Leo Burnett, Starcom, MediaVest, etc.) in 2002. The move into the digital world began with the acquisition of Digitas (2006), followed by Razorfish (2009), and Rosetta (2011). The acquisition of Sapient in early 2015 opened new avenues for Publicis beyond its core business into marketing, omni-channel commerce and consulting.

Mr. Maurice Lévy co-founded the Institut français du Cerveau et de la Mœlle Épinière (ICM) in 2005 and today chairs the Board of Directors of numerous organizations, including the Peres Center for Peace and Innovation, and, since October 2015, the Institut Pasteur-Weizmann . He has also received numerous distinctions for his work and his fight for tolerance. He is Commandeur de la Légion d’honneur and Grand Officier de l’ordre national du Mérite .

Pursuant to the internal rules and regulations of the Board of Directors, the Emeritus Chairman may attend the meetings of the Board of Directors in an advisory capacity only.

Mr. Maurice Lévy shares with the Board his experience, his expertise, his intimate knowledge of the Groupe and his privileged relationships with the Groupe’s key contacts in France and around the world.

In addition to his duties as Emeritus Chairman, Mr. Maurice Lévy chairs an innovation and prospective working group. This group, which is separate from the Board Committees, is composed of three Independent Directors, three members of the Executive Committee and the Secretary General of the Publicis Groupe. This is an internal think tank on topics related to innovation and strategic options for the future. It met once in 2024 to establish its composition, its working method and its initial areas of reflection. Information and documents are exchanged between meetings. The Chairman and Chief Executive Officer is informed of the work of the working group. A second meeting of this working group is scheduled for May 2025. This specific mission, entrusted to Mr. Maurice Lévy, is part of a service agreement entered into with the Company, approved by the Board of Directors.

The Emeritus Chairman is not a corporate officer. However, he is subject to the same rules of confidentiality and ethics as those applicable to Directors, including the Groupe’s Janus Code of Ethics and the rules relating to the prevention of market abuse. As such, he is subject to compliance, with the obligations to abstain from trading in Publicis Groupe SA shares during “blackout periods.”

Similarly, in the event of a conflict of interest, even a potential one, in which the Emeritus Chairman may be directly or indirectly involved, the latter must also refrain from attending or participating in the discussions concerning the corresponding deliberation, or requesting any document or information in any form whatsoever relating to the subject in question.

The Groupe has a set of rules governing its behavior and ethics under the name “Janus.” It is applicable to all of the Groupe’s hierarchical levels and sets out the rules of conduct for operations: “The Publicis way to behave and to operate.” It is regularly updated, distributed across all internal networks and is available in seven languages.

Janus includes the rules and principles related to ethics, corporate social responsibility, compliance with regulatory and legal frameworks, governance, communication, conducting business and client relations, human resource management, protecting the Groupe’s brand names, other intellectual property rights and financial and accounting management, as well as rules governing mergers and acquisitions, investments, restructuring and purchasing policies.

The guidelines include a Code of Conduct and Ethics applying to all Groupe employees with specific rules for the main executives. The values embodied by Publicis are clearly outlined there, starting with our commitment to our clients and respect for individuals and their diversity.

The aim of these rules of conduct is to provide the Groupe with strict rules and procedures for running our business worldwide in all fields: human resources management, ethics, financial management, individual responsibility. They are meant to prevent any illegal activity, in particular by ensuring that Groupe employees comply with laws and regulations which govern business conduct. The Groupe’s rules of conduct are also meant to prevent favoritism, misappropriation of funds, breach of trust, corruption, conflicts of interest or other misconduct and subject the Groupe and its employees to the highest standards in terms of integrity, ethics and compliance. They are designed to protect the Groupe’s data and know-how by establishing strict guidelines regarding confidentiality and good faith. They establish procedures for control and reporting by management of the Groupe and of the various networks of any breach of these policy rules. Certain policies have been made public.

This code was updated on May 25, 2022, with revisions scheduled once or twice a year. The last update was made in February 2024, and training sessions are arranged for all employees.

The Janus Code public policies are available on the Groupe’s website (www.publicisgroupe.com) in the “Corporate Social Responsibility” section, under “Library” then “Code of Conduct and Ethics.”

Janus provides detailed rules on stock market ethics in a specific chapter. The Groupe’s objective is to ensure compliance with the laws and regulations in force, as well as the recommendations issued by the AMF, in the area of risk management related to the holding, disclosure or possible use of insider information.

- define insider information and the related general rules of its use;

- determine the specific rules applicable to persons holding insider information;

- specify the administrative and/or criminal penalties applicable to a breach of the obligations related to holding insider information; and,

- detail the preventive measures.

These rules apply to any employee, corporate officer or executive corporate officer of the Company who has insider information, to their spouses and children, as well as to any person living in their household, until the information is publicly disclosed.

In addition, the Groupe has drawn up a list of employees, corporate officers and executive corporate officers with regular or occasional access to insider information and has set blackout periods during which these persons, and persons closely related to them, are prohibited from, on their own behalf or on behalf of the account of a third party, directly or indirectly, any transaction involving the Company’s securities, derivatives or other related financial instruments (unless authorized by the Company, pursuant to the regulations in force).

This specific chapter is regularly reviewed to adapt to legislative and regulatory changes and to take into account the recommendations of the AMF.

Extract from article 1 of the internal rules and regulations of the Board of Directors:

All Directors must comply with the laws and regulations that govern the position of Director of a société anonyme and, in particular, the rules with respect to: